Picture this: you’re standing at a crossroads, one path leads to an inevitable date with the tax man, and the other meanders towards a tax deferral strategy known as a DST 1031 Exchange. Sounds like fantasy? Think again. Real estate investors are harnessing this little gem to keep more cash in their pockets.

Forget the magic wand—it’s time to get educated and see how these real estate exchanges utilizing a DST 1031 Exchange can be your portfolio’s savior when taxes come due. You’ll learn how these exchanges work and why they could be your portfolio’s knight in shining armor when capital gains taxes loom large.

We’ve got strategies lined up that’ll make those hefty tax bills feel like distant memories. Imagine turning profits from one property into multiple income streams without Uncle Sam dipping his fingers into your pie…

Curious yet? Let’s dive deeper together; after all, knowledge is power—and profit.

Table Of Contents:

- Understanding the Basics of a DST 1031 Exchange

- The Process of Executing a DST 1031 Exchange

- Advantages of Investing Through DST Properties

- Investment Strategies Involving DSTs for Diversification

- DST vs. Traditional Real Estate Investments

- The Selection Criteria for Replacement Properties in a DST Exchange

- Navigating Tax Implications with DST Investments

- Getting Started with Investing in DST Properties

- Evaluating Performance & Risks Associated with DST Offerings

- FAQs in Relation to Dst 1031 Exchange

- Conclusion

Understanding the Basics of a DST 1031 Exchange

Whispers about Delaware Statutory Trusts (DSTs) and their potential to help defer capital gains taxes might have been heard if you’ve taken the plunge into real estate investing. It’s not hocus pocus; it’s all about strategy—and understanding how to use a DST for 1031 exchange is like learning the ultimate tax-saving spell.

What is a Delaware Statutory Trust?

A DST is more than just an impressive-sounding acronym—it’s an ingenious legal structure that lets many investors own shares in large-scale properties. Think of it as joining forces with other investors to get a slice of something big, like multifamily apartment complexes, Triple Net Lease Retail buildings, Senior Living, Self Storage, Industrial, Government Buildings, all without needing to manage them directly yourself. By pooling resources through this statutory trust, even smaller players can play ball in the major leagues of real estate investing.

DST investments are pretty slick since they offer potential consistent income streams and appreciation—music to any Exchange Investor. But remember, while the allure of regular, passive cash flow can be strong, there’s no such thing as free lunch—you’ve got to understand what you’re getting into.

The Role of DSTs in Deferring Capital Gains Taxes

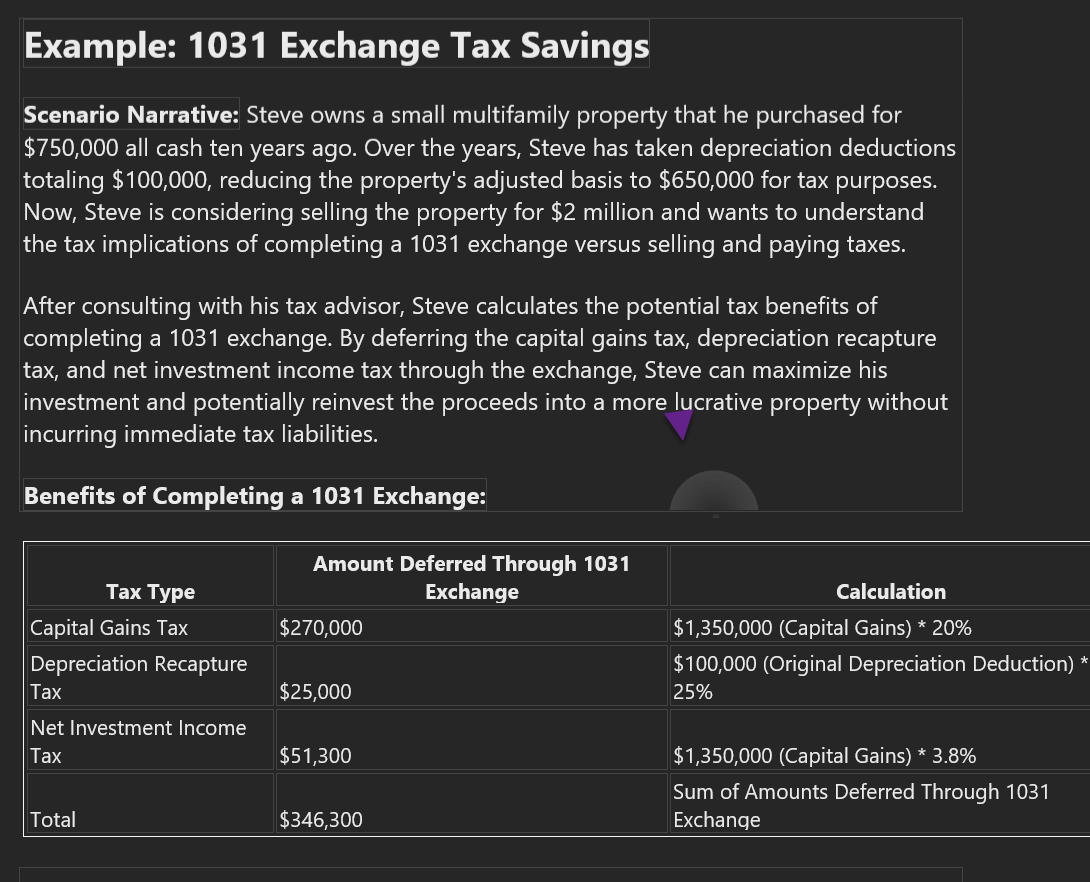

You love making profits on your investments—who doesn’t? But when Uncle Sam comes knocking for his share via capital gains taxes, suddenly those profits feel less exciting. Enter: The majestic 1031 exchange DST maneuver where savvy investors dance around hefty tax bills by reinvesting sales proceeds into new property slices within specific time frames—keeping their money working rather than paying out chunks right away.

This isn’t pocket change we’re talking about either; using DSTs correctly within the 1031 exchange process, one could defer both capital gains and depreciation recapture taxes—that’s double-barreled savings aimed straight at maximizing returns on investment.

Dive into the real estate big leagues with a DST 1031 exchange, letting you team up with others to own large properties and defer taxes like a pro.

Carnegie Wealth Management can assist you with your DST selection process.

The Process of Executing a DST 1031 Exchange

So, you’re looking to keep Uncle Sam’s hands off your capital gains for a bit longer? A smart move indeed. The Delaware Statutory Trust (DST) can be your golden ticket to deferring those pesky taxes. But like any great heist movie, timing is everything.

Eligibility Criteria for Investors

To join in on the action, you’ll need to meet certain criteria; no special handshake required. To play the game, you’ve got to own investment property and have an appetite for tax deferral strategies that would make even the most seasoned investor nod approvingly. You’re looking at swapping ‘like-kind’ real estate here; think exchanging one income-producing asset for another – all without immediately triggering capital gains taxes.

If that sounds up your alley and you’re not new around these parts—meaning you’ve been through the exchange rodeo before—you’ll find DSTs might just fit like your favorite pair of cowboy boots.

Timelines and Deadlines to Consider

Buckle up because we’re racing against time now. Once you sell your property, the clock starts ticking louder than crocodile following Captain Hook—you’ve got 45 days to pinpoint potential replacement exchange properties which could include those shiny DST investments. And let’s say it together: procrastination is not an option.

Sell today? Then mark that calendar because within 180 days—the same amount of time it takes some people to forget where they put their keys—you need everything wrapped up with a bow on top; otherwise, prepare yourself for good ol’ fashioned tax bill greeting card from IRS HQ.

Advantages of Investing Through DST Properties

Imagine kicking back, your feet up, while a potential stream of income flows into your bank account. That’s the passive income potential when you dive into Delaware Statutory Trust (DST) properties. These investments are like hidden gems in a treasure chest that not only aim to stuff your pockets but also spread out the risk with their diversification opportunities.

If you’re tired of dealing with tenants or fixing toilets at midnight, then DSTs could be your ticket to freedom. They let real estate investors get their hands on property investment deals usually reserved for the big dogs – think multifamily apartment buildings and large commercial spaces – without needing an overflowing wallet since they typically require just a low minimum investment amount.

The charm doesn’t stop there; these nifty structures provide access to diversified portfolios where one can own pieces of several properties rather than putting all eggs in one basket. This isn’t just about spreading joy across different types of real estate – it’s smart strategy. You might have heard through the grapevine how vital this is for long-term stability and peace-of-mind investing.

Apart from sweetening the pot with potential tax deferral perks related to capital gains taxes, which by now should make any investor’s ears perk up like a meerkat on guard duty, there’s more good news. If direct cash investments feel as outdated as flip phones, DSTs offer an alternative path forward.Here’s something interesting: experts point out that savvy folks use leftover equity from exchanges in clever ways to defer those pesky capital gains bullets altogether.

No wonder Carnegie Wealth Management recommends them to select clients; they’re quite the catch if you want part ownership without full-time headaches caused by active management duties. So before Uncle Sam comes knocking for his share of pie slices called recapture taxes after selling off prized possessions… why not check out what swapping over via 1031 exchange into DST might mean for keeping more dough in your pocket?

DST properties offer a chill way to earn cash without the landlord blues. They’re perfect for joining the big league of real estate with less cash upfront. Plus, they spread out risk and can help you dodge capital gains tax—talk about a sweet deal.

Investment Strategies Involving DSTs for Diversification

If you’re playing the long game in real estate investment, spreading your chips across the board with Delaware Statutory Trusts (DSTs) could be a savvy move. Picture this: You’ve just sold an asset and are sitting on some gains. Rather than pay capital gains taxes now, why not roll that dough into diverse income-producing properties?

That’s where DST investments come to shine.

Diving deeper, let’s talk about diversification and true passivity. Imagine you’re like a conductor of an orchestra but instead of music, it’s real estate assets harmonizing together under one trust roof. This strategy isn’t just smart; it lets you sit back while professionals handle the active management—a relief if being a landlord has ever given you grey hairs.

And here’s something juicy: leftover equity from exchanges can sidestep those pesky capital gains taxes. Think of debt replacement as swapping your old property shoes for new ones without getting taxed on how shiny they are. By involving various types of income-generating properties—say apartment buildings or Triple Net Lease spaces—you’re essentially covering all bases like a seasoned baseball player guarding his diamond against uncertainties.

A complete guide to DSTs and 1031 Exchanges, digs deep into these advantages.

Moving along, cover strategies can include direct cash investments into DSTs providing true passivity in managing your portfolio—like having autopilot engaged while flying through investment skies. But remember folks, even autopilots need good navigation systems; thus selecting solid sponsors is crucial when embarking on this journey towards diversified success.

Kiplinger, another trusted resource offers insights into how strategic financial moves using trusts work wonders for wealth preservation.

So whether you’re looking at DST 1031 offerings or simply trying to dodge capital gain battles by deferring them indefinitely—the artful maneuvering involved with investing through Delaware Statutory Trust might just make sense for your portfolio symphony.

Diversify your real estate game with DSTs to delay capital gains taxes and enjoy hands-off management. Think autopilot for investments, but choose your co-pilots wisely.

DST vs. Traditional Real Estate Investments

Imagine a buffet of investment options—traditional real estate is like your comfort food, while Delaware Statutory Trusts (DSTs) are the exotic dish you’ve heard whispers about. DST investments often come with minimal investment requirements, allowing you to dip your toes into institutional quality real estate without diving headfirst into direct ownership’s complexities.

Now, think traditional real estate; it’s hands-on and gives you control down to the last shingle on the roof. But with that control comes all the hassles of active management—from tenant issues to unexpected maintenance costs. That’s where DSTs shine; they’re a passive play that lets investors kick back and potentially enjoy consistent cash distributions—a contrast as stark as investing in a bustling city center apartment building versus owning a quiet suburban home.

In this realm, we find folks who have exchanged properties through 1031 exchanges finding peace in knowing their capital gains tax can be deferred when choosing DST properties for their next move. It’s akin to hitting pause on an intense action movie—you know there’s more coming but for now, breathe easy because those gains taxes aren’t knocking at your door just yet.

The Role of Minimal Investment Requirements

Digging deeper into this financial feast, let’s carve out what makes dst vs traditional real estate different starting with dollar signs—the entry ticket if you will. You might need significant dough to break bread in conventional property deals but entering the world of DST investments, could start at prices comparable to buying a new car rather than an entire dealership.

Cash Distributions: The Icing on Top?

Bite-sized chunks make up these trust structures allowing diversification not just across one or two buildings but potentially a handful of DST properties across different states. Imagine spreading seeds far and wide waiting for them all to bloom—that’s how diversified portfolios work within DSTs compared against sinking funds solely into one single NNN lease structure. The let’s not have “All Your Eggs in One Basket” strategy.

Picking Your Piece Of Pie Wisely

Last tidbit before our culinary journey ends: When it comes time for picking replacement properties as an exchange investor—it feels less ‘needle-in-a-haystack’ stressful thanks partly due diligence processes set by seasoned 1031 DST sponsors.

The Selection Criteria for Replacement Properties in a DST Exchange

Choosing the right replacement property in a Delaware Statutory Trust (DST) exchange is like picking the perfect avocado—it’s all about timing, quality, and matching your taste. But instead of making guacamole, you’re looking to defer capital gains taxes with a suitable replacement property that ticks all the boxes.

Sizing Up Your Investment: The 1031 Into DSTs Advantage

If you’ve ever wondered why savvy investors often eye multifamily apartment buildings when considering DSTs for their 1031 exchanges, it’s simple—they’re attractive because they promise both potentially consistent income streams and potential appreciation. Now imagine being able to get into this game without having to manage tenants or fix leaky faucets; that’s where DSTs shine.

By allowing investors to replace like-kind properties while sidestepping capital gains taxes, these trusts turn real estate investing into less of a chore and more of an opportunity.

But not just any old real estate property will do—you’ll want one that aligns with your investment goals and financial strategy. Think about location, tenant demographics, and long-term growth prospects before signing on the dotted line. And remember—the goal here isn’t just to park your money but also to watch it grow.

Dialing In on Debt: Leveraging Non-Recourse Loans

Purchasing power can be amped up through non-recourse loans offered by many DST investments—kinda like using someone else’s credit card but with none of the personal liability if things go south. A direct cash investment for DSTs typically might start at $100k minimum, letting even those who aren’t swimming in gold coins join in on prime real estate deals.

To navigate these waters successfully though—and keep Uncle Sam’s hands off your wallet—a strategic deferral plan must be part of every step along this exciting journey Kiplinger advises. So roll up those sleeves because there’s work to be done.

Picking the right DST property is like choosing a ripe avocado: it’s about quality and fit. DST properties offer potential income and growth without landlord hassles.

Boost buying power with non-recourse loans in DSTs. Keep tax deferral top of mind to protect your profits.

Carnegie Wealth Management can assist in recommending experienced DST Sponsors.

Navigating Tax Implications with DST Investments

So, you’ve decided to spice up your investment game and now you’re eyeing Delaware Statutory Trust (DST) investments for their tantalizing tax deferral perks. Smart move. But before we waltz into this financial fiesta, let’s get the skinny on how a DST can keep that pesky capital gains tax at bay.

Diving headfirst into a pool of acronyms like DST, deferring capital gains taxes might sound about as complex as rocket science—but fear not. It’s more like baking a cake; follow the recipe right, and you’ll enjoy the sweet rewards without burning down the kitchen.

The Sweet Spot: Deferring Taxes with DSTs

Understanding how DSTs work within 1031 exchanges is key. Think of it as swapping one real estate dessert for another—without having to share any slices with Uncle Sam just yet. You sell your property but instead of pocketing the dough, roll it into a trusty DST which plays by rules so tight they make skinny jeans look baggy.

This switcheroo lets investors defer both capital gains taxes and depreciation recapture. That means keeping more cash in hand today rather than handing it over during tax season—a strategic money tango if there ever was one.

Avoiding Taxable Boot: The Not-so-secret Dance Step

“Taxable boot” sounds like something out of an old western flick but stick with me here—it’s actually what could trip up your whole strategy faster than saying “tax evasion.” To avoid getting booted by taxable income from an exchange, ensure every cent goes toward purchasing new property. We’re talking zero loose change; otherwise, say hello to immediate taxation on those stray coins.

You need everything tied up neat in that replacement property bow—and yes, even though minimal effort is required from investors thanks to passive management through professionals—you still gotta watch where each penny drops or risk stirring trouble come audit time.

Footing Your Future Bill: What Happens Next?

We’ve established that jumping onto the DST train can be smooth sailing when done correctly—with experts whispering sweet nothings about potentially consistent income streams and appreciation potential along for the ride too. However remember folks—the bill isn’t forgiven forever; think deferred not deleted when calculating long-term plans because someday those taxes will tap on your shoulder asking politely yet firmly…to get paid.

Spice up your investment portfolio with the DST option to defer capital gains tax—like swapping desserts without giving Uncle Sam a bite. Watch every penny, avoid the “taxable boot,” and remember, deferral isn’t deletion.

Getting Started with Investing in DST Properties

Dipping your toes into the world of Delaware Statutory Trust (DST) properties might seem like navigating a labyrinth, but it’s more like following a treasure map where X marks the spot for tax deferral. For starters, if you’re looking to bypass hefty capital gains taxes on real estate profits, direct cash investments in DSTs could be a smart move.

Now let’s talk turkey about what it takes to jump aboard this investment train. We’re not just pulling numbers out of thin air; typically, investors need at least $100k to get their foot in the door of these institutional quality real estate solutions. And hey, that entry fee opens up options for leveraging non-recourse debt—because who doesn’t love using other people’s money smartly?

If you’re sitting there wondering how single NNN properties fit into all this—or maybe what “NNN” even stands for—think triple net lease: tenants handle most property expenses while investors potentially enjoy predictable returns without getting hands dirty with active management.

The best part? When DSTs provide passive income and potential appreciation without needing you to play landlord every day—it’s kind of like having cake and eating it too. But remember folks; just because something shines doesn’t mean it’s gold. It pays off big time to do some homework, or better yet partner up with reputable sponsors who know their way around these trusts.

To set sail smoothly on your investment journey through the seas of 1031 exchanges into DSTs, consider each step carefully—from spotting red flags to comparing DST 1031 offerings and fees until finding one that fits snug as a glove. You wouldn’t buy shoes without trying them on first right? The same goes here; only instead of blisters from ill-fitting shoes, we’re avoiding financial pinches down the road.

Dive into DST properties with a typical minimum investment of $100k and snag tax deferrals like a pro. Remember, triple net leases can mean chilling out while tenants pay the bills. But keep your eyes peeled—choose trusted partners and dodge those financial blisters.

Evaluating Performance & Risks Associated with DST Offerings

When you’re eyeing a DST for your 1031 exchange, it’s like sizing up a chessboard. You need to know the moves and potential checkmates—basically, how well these investments perform and what risks they carry. To do this right, let’s talk numbers and real-world scenarios.

DST Trust 1031: A Balancing Act of Potential Returns vs Risk

You might think diving into a Delaware Statutory Trust is as straightforward as jumping on the bandwagon of deferring capital gains taxes—but hold your horses. It’s crucial to weigh both performance metrics and associated risks before making any moves. Remember that diversified portfolios are like seasoning in cooking; they add flavor—or in investment terms, potentially reduce risk—and can potentially boost returns compared to putting all your eggs in one basket with single-tenant or multifamily buildings alone.

But just because diversification sounds fancy doesn’t mean it lacks substance. In fact, by spreading investments across various property types within a DST offering, experts argue that you could balance out volatility from market fluctuations—because when one sector dips, another might be thriving.

Finding Your Match: Sifting Through DST Sponsors

Achieving success with DSTs isn’t just about picking properties—it’s also about choosing the right dance partner (or sponsor). The track record of sponsors can speak volumes; after all, would you take tango lessons from someone who’s only mastered ballet? Make sure those handling your investment have not only grace but grit—the experience to navigate through economic ups and downs.

To dig deeper into historical data on performances or possible pitfalls, look no further than detailed analyses offered by reputable sources such as Kiplinger. They help peel back layers so investors can spot trends without getting tangled in marketing fluff.

In summary, knowing where the potholes lie makes for smoother driving—or investing if we stick to our analogy lane here. So don’t skimp on due diligence; after all, being bold does pay off, but being blindfolded while at it surely doesn’t.

Dive into the numbers and scenarios before jumping on a DST. It’s not just about tax breaks—balance risk with potential returns, diversify your portfolio to manage market ups and downs, and pick a sponsor who knows how to tango through tough times.

FAQs in Relation to Dst 1031 Exchange

What is a 1031 DST exchange?

A DST exchange lets investors defer taxes by swapping investment properties for shares in a Delaware Statutory Trust’s real estate.

Can I 1031 into a Delaware Statutory Trust?

You can indeed use Section 1031 to roll your investment into a DST, deferring capital gains tax efficiently.

What is the downside to a Delaware Statutory Trust?

DSTs limit investor control and liquidity; they also come with management fees and potentially lower appreciation than direct ownership.

What is the difference between a 1031 tic and a DST?

Tenants-in-common (TIC) offer direct property ownership stakes, while DSTs provide indirect interest via trust beneficial shares.

Conclusion

Wrap your head around this: a DST 1031 exchange can be your tax deferral hero. We’ve walked through the what, why, and how of leveraging Delaware Statutory Trusts to push those capital gains taxes down the road.

Dive into it; remember that timing is everything. You’ve got strict deadlines to find and close on suitable properties. But don’t sweat it—diversification’s within reach with a variety of potentially income-generating assets under one trust umbrella.

Get strategic; use debt replacement smartly in your DST investments for better financial footing. Keep an eye out for backup options when traditional exchanges hit snags—you’ll thank yourself later.

Above all, stay sharp; understand the potential returns on investment when picking replacements. It’s not just about deferring taxes but also about growing wealth sensibly.

In essence, grasp these insights and you’ll navigate real estate investment like a pro—with more money lining your pockets instead of filling government coffers.