Imagine you’ve stumbled upon a hidden pathway in the tax code forest, one that leads to a treasure trove of savings. That’s what IRC Section 1031 is for savvy real estate investors—your map to deferring capital gains and depreciation recapture taxes when you swap one investment property for another. It’s like getting an extra life in your financial game plan.

Now picture this: You’re holding two puzzle pieces—one is your current property and the other, a new opportunity. With IRC Section 1031, these pieces can fit together perfectly without Uncle Sam reaching into your pocket right away.

I know it sounds almost too good, but stay with me because by diving deeper into this guide, you’ll learn how to navigate through swaps smoother than silk and come out ahead on tax day. Welcome to the world of IRC Section 1031 Tax Deferred Exchange.

Table Of Contents:

- Understanding IRC Section 1031 and Like-Kind Exchanges

- Navigating the Exchange Process Under IRC Section 1031

- Role of Qualified Intermediaries in IRC Section 1031 Exchanges

- Changes to IRC Section 1031 by the Tax Cuts and Jobs Act

- Maximizing Benefits Through Strategic Investment Properties

- The Future Outlook for Real Estate Investments Using IRC Section 1031

- Real-Life Applications Case Studies Demonstrating Successful Outcomes

- Decoding Terminology: Key Terms Definitions Within IRS Code

- Conclusion

Understanding IRC Section 1031 and Like-Kind Exchanges

Ever feel like you’re playing a high-stakes game of Monopoly, but with real buildings? That’s the vibe of IRC Section 1031. It lets investors swap one investment property for another—like trading Boardwalk for Park Place—and delay paying capital gains and depreciation recapture taxes on the deal.

So why is this move smoother than a slick real estate agent at closing?

The Basics of Like-Kind Property

Here’s where it gets juicy: “Like-kind” sounds broad, but we’re not talking apples to oranges here; think more Granny Smiths to Golden Delicious. In IRS speak, real property held for business or investment can play ball in this exchange game.

You’ve got options ranging from triple net lease retail to Senior Living to Self Storage to US Government Buildings to Medical to raw land—as long as both your relinquished property and replacement property are in the U.S., Uncle Sam gives a nod of approval.

Tax Advantages for Real Estate Investors

Paying less tax now means more cash on hand— more cash to reinvest. But don’t get too overly excited; these swaps need careful planning because if they aren’t properly structured—you guessed it—the tax man cometh. By using strategies that fall within IRC regulations, savvy investors defer those capital gain taxes potentially indefinitely—which is how some end up sitting pretty atop hefty portfolios without ever cutting a check to the Internal Revenue Service.

A quick tip from someone who has navigated these waters: Get yourself an ace Qualified Intermediary (QI) before even whispering about exchanging properties—they’ll be your guide through what might seem like federal tax code hieroglyphics.

Smart Real Estate investors have been doing like-kind exchanges for more than 100 years—it’s nothing new under that hot real estate sun. Since its inception into our beloved revenue code, investors have used it as their golden ticket against immediate capital gains taxation—a nifty way to upgrade assets while keeping more money invested.

Carnegie Wealth Management can answer your 1031 Exchange Questions & Concerns.

Think of IRC Section 1031 like a real estate power move—swap properties, keep more cash to reinvest, and pay less tax. Just make sure you trade similar kinds of property the IRS term like-kind) and have a pro by your side to navigate the tricky tax rules.

Savvy investors use this strategy to build wealth without the immediate hit from capital gains and depreciation recapture taxes. It’s an old trick but still golden for growing portfolios while deferring Uncle Sam’s cut.

Navigating the Exchange Process Under IRC Section 1031

Stepping through a like-kind exchange can feel like navigating a labyrinth, but it doesn’t have to. Think of IRC Section 1031 as your trusty map, guiding you to defer capital gains taxes by swapping one investment real estate for another.

Meeting Identification and Timing Requirements

The clock starts ticking once you sell your property. You’ve got just 45 days to identify potential replacement properties—this is where strategy plays its part. Miss this deadline, and the tax benefits vanish faster than ice cream on a hot day. And don’t forget about completing the entire exchange within 180 days; otherwise, Uncle Sam will be knocking at your door for his share.

To nail these deadlines, consider marking them in red on every calendar you own—the importance cannot be overstated. With each tick of the second hand, remember that real estate tax tips from IRS could help keep those dollars in your pocket rather than floating into government coffers.

A qualified intermediary should become your new best friend during this process because they’re crucial for keeping things above board with the Internal Revenue Service (IRS). They hold onto sale proceeds so you won’t get tempted or accused of having constructive receipt—which is a definite no-no if deferring taxes sounds appealing to you.

All jesting aside though, these rules are rigid for good reason: To qualify exchanges under internal revenue code regulations—and who wouldn’t want their exchange transaction properly structured?

The Importance of Precision in Property Selection

Picking out replacement properties isn’t akin to choosing what socks to wear—it’s more serious business here since not all real estate property fits ‘like-kind’ criteria according to our friends at IRS Code Section 1031 guidelines.

Your choices needn’t mirror-image your relinquished property—an apartment building can indeed replace raw land—but they must both meet ‘investment’ status criteria set forth by current federal tax laws.

Digging deeper beyond surface-level similarities ensures that when exchanging solely within realms dictated by IRC Section 1031 requirements—a successful outcome lies ahead. And hey—who doesn’t love success especially when it involves less interaction with ordinary income gain types?

Think of IRC Section 1031 as a tax-deferral compass for real estate swaps. You’ve got strict timelines: 45 days to identify and 180 days to complete the exchange. Miss these, and your tax breaks melt away.

Get a qualified intermediary on board fast—they’re key to keeping you in line with IRS rules and protecting your pocket from unwanted tax hits.

Pick replacement properties wisely; they must fit ‘like-kind’ investment criteria, not just look similar. Stick to the code, avoid ordinary gains, and sail towards success.

Role of Qualified Intermediaries in IRC Section 1031 Exchanges

Think of a Qualified Intermediary (QI) as the maestro conducting an orchestra, where every musician must hit their notes at just the right moment. In a like-kind exchange under IRC Section 1031, this ‘maestro’ is essential for orchestrating the complex steps required to ensure that real estate investors stay in tune with IRS regulations.

The Nuts and Bolts: How QIs Keep You Compliant

A QI’s role isn’t just about holding your hand through the tax deferral process—it’s about protecting you from inadvertently playing a wrong note that could lead to heavy penalties. They are responsible for holding proceeds from the relinquished property sale, thus helping investors avoid constructive receipt issues which can disqualify an exchange transaction faster than you can say “audit”. But it’s not all defense; these intermediaries are also there to maximize benefits by steering clear of capital gains taxes like a pro avoiding potholes on a race track.

In addition, when we talk compliance with IRS regulations for 1031 exchanges, timing is everything—miss your cue and watch that sweet harmony turn into discordant noise. Here’s where our trusty QI jumps back into play—they’re clock-watchers extraordinaire. With strict deadlines like identifying potential replacement properties within 45 days and closing within 180 days, having someone who has eyes on these timelines ensures no beat is missed.

Tax Reform Tunes: Adapting to Legislative Changes

You might think you know all there is about swapping properties until Uncle Sam changes up the rhythm section—the Tax Cuts and Jobs Act did just that by striking personal property off the list of eligible assets for like-kind exchanges effective January 2018. Only real property now makes it onto this exclusive chart-topper list. Our adept QIs keep themselves updated so they can guide clients through shifting landscapes without missing a step or falling out of key.

No one wants their financial symphony marred by unexpected solos—and rest assured, qualified intermediaries exist precisely because soloing without backup here could cost more than applause; it could trigger federal tax implications nobody wants as part of their repertoire.

Carnegie Wealth Management can recommend experienced and knowledgeable Qualified Intermediaries for your exchange.

Think of Qualified Intermediaries as your tax-deferral maestros, keeping you in harmony with IRS rules and saving you from costly missteps. They watch the clock on crucial deadlines to make sure your real estate exchange hits all the right notes.

Changes to IRC Section 1031 by the Tax Cuts and Jobs Act

The landscape of tax-deferred exchanges experienced a seismic shift with the passing of the Tax Cuts and Jobs Act. If you’ve been playing in the real estate sandbox, leveraging your properties’ equity without shelling out for capital gains taxes, then listen up. The rules have changed.

Gone are the days when your collection of vintage Ferraris or that abstract painting from an obscure artist could dance through a like-kind exchange. Now, it’s all about real property. That’s right—only real property is invited to this exclusive party, as personal and intangible items got booted off the guest list after December 31st, 2017.

This shake-up means if you’re eyeing an apartment building as your next chess move in this high-stakes Monopoly game we call investing, you’re golden—as long as both properties meet that “like-kind” criteria under IRC Section 1031 regulations.

The Basics of Like-Kind Property

Let’s break down what “like-kind” really means post-Tax Cuts era: It’s not about two apartments shaking hands or parcels of land exchanging knowing glances—it’s broader than that. Imagine trading one piece on a Monopoly board for another; they’re different but fundamentally serve the same purpose in your quest for financial domination.

A plot twist though—the term “real property held for use in trade,” gets thrown around more than confetti at Times Square on New Year’s Eve—but don’t let it confuse you. Essentially, it just refers to any non-personal assets used within business operations or investment contexts that can be exchanged tax-free—if structured properly.

Tax Advantages for Real Estate Investors

Dive into these changes headfirst because there are still ripe opportunities to save big bucks on potential gain taxes—after all, why pay Uncle Sam earlier than necessary? This little gem allows investors to keep rolling their dough into newer investments while deferring income tax hits until they cash out completely (or die).

To wrap our heads around how significant this is—think Jenga tower made entirely from dollar bills—you want those stacks high and stable before pulling anything out.

Real estate investors, take note: Only real property qualifies for tax-deferred exchanges under the revamped IRC Section 1031. Say goodbye to personal items and hello to like-kind properties—think trading one Monopoly piece for another. Keep stacking your investments high while deferring taxes.

Maximizing Benefits Through Strategic Investment Properties

In real estate, smart investors recognize that exploiting the tax regulations can be just as crucial as deciding on a suitable location when it comes to amassing wealth. Enter IRC Section 1031, a powerful tool that lets you defer capital gains taxes by reinvesting proceeds from one property into another. But not just any replacement property will do; strategic selection is key.

The Basics of Like-Kind Property

To start off strong, understand what like-kind really means. It’s broader than many think—most real estate properties are considered like-kind to each other under Internal Revenue Code guidelines. This opens up opportunities beyond your initial investment niche or geographic preference and can lead to some pretty lucrative deals.

We’re talking about exchanging an apartment building for raw land or a strip mall for an office complex—the possibilities stretch as far as your real estate dreams go.

Tax Advantages for Real Estate Investors

So why get tangled in this web? Because with careful planning and timing, you could use these exchanges not just once but repeatedly over time to grow your portfolio while keeping Uncle Sam at bay when it comes to those pesky capital gain and depreciation recapture taxes.

You heard right. Instead of paying income tax on each sale, keep rolling profits into new investments—a kind of Monopoly game where passing ‘Go’ doesn’t trim down your cash stack with taxes due (as long as rules are followed).

Evaluating Potential of a Like-Kind Exchange

Picking winners isn’t only about gut feeling—it’s strategy meets math meets street smarts. The first step? Assessing potential growth versus risks involved with the targeted investment properties because let’s face it: every property has its quirks and perks.

A downtown high-rise might offer stability and solid rent rolls but watch out for those city ordinances tightening their grip on landlords.

- Dive deep into local market trends; they’ll tell tales future spreadsheets won’t see coming.

- Analyze tenant demographics—are they stable enough?

IRC Section 1031 is your secret weapon to dodge capital gains taxes and keep building wealth. Swap one property for another, think bigger, mix it up with different real estate types.

Dive into the fine print of what ‘like-kind’ covers—it’s probably more than you think. This means more chances to strike gold in new markets or niches.

Don’t just trust your gut—do the homework on properties to spot growth potential and avoid hidden pitfalls. Look at market trends and tenant profiles closely; they can make or break your deal.

The Future Outlook for Real Estate Investments Using IRC Section 1031

Peering into the crystal ball of real estate investments, savvy investors keep a close eye on potential legislative shifts that could touch upon the storied IRC Section 1031 like-kind exchanges. Known as a cornerstone of tax-savvy investing, this part of the Internal Revenue Code lets you swap one investment property for another without immediate capital gains taxes nipping at your heels.

But here’s where it gets spicy: whispers in Washington suggest changes might be on the horizon. What does that mean? Well, imagine if those deferrals got harder to snag or even—gasp.—vanished like doughnuts at an office meeting. Now don’t panic yet; nothing’s set in stone. But let’s say adjustments do happen—they could shake up strategies from coast to coast.

Potential Legislative Tweaks and Their Impact

Rumblings about reform have been making rounds among those who track every ebb and flow within our beloved Tax Cuts and Jobs Act arena. The act currently states clear as day: only exchange real property if you want to play this game—leave personal knick-knacks out of it.

Should these murmurs become law, we may see a tighter leash around what counts as fair game for swapping properties without facing Uncle Sam’s tax bite right away. Investors would need fresh tactics—a sort of Houdini-like finesse—to make sure their wealth-building magic tricks still bring down the house.

Gazing Through A Pragmatic Lens

Cut through all the jargon and legalese surrounding terms like “real property held”, “deferred gain taxes”, or “like-kind replacement”. It boils down to this: getting ahead means staying informed—and not just by reading headlines but diving deep into documents like Form 8824 from IRS regulations themselves.

You’ve gotta know when to hold ’em and how long—you’re looking at key stats suggesting significant alterations could tweak application processes big time. If done wrong, you risk losing more than Monopoly money—it’s your hard-earned cash we’re talking about.

All jesting aside though folks—if legislation pulls new moves out its sleeve concerning IRC Sec 1031 exchanges or perhaps dabbles with ideas from sections akin to irc section 1033 exchange nuances—we must adapt swiftly lest our portfolios feel less than jubilant.

Keep a sharp eye on possible changes to IRC Section 1031—it’s vital for tax-smart real estate moves. If new rules hit the books, be ready to switch up your game plan.

Understanding IRS forms and regulations is key. Dive deep, not just skim the surface—your wallet will thank you.

If legislative shifts tweak IRC Section 1031 or similar areas, quick adaptation will keep your investments smiling.

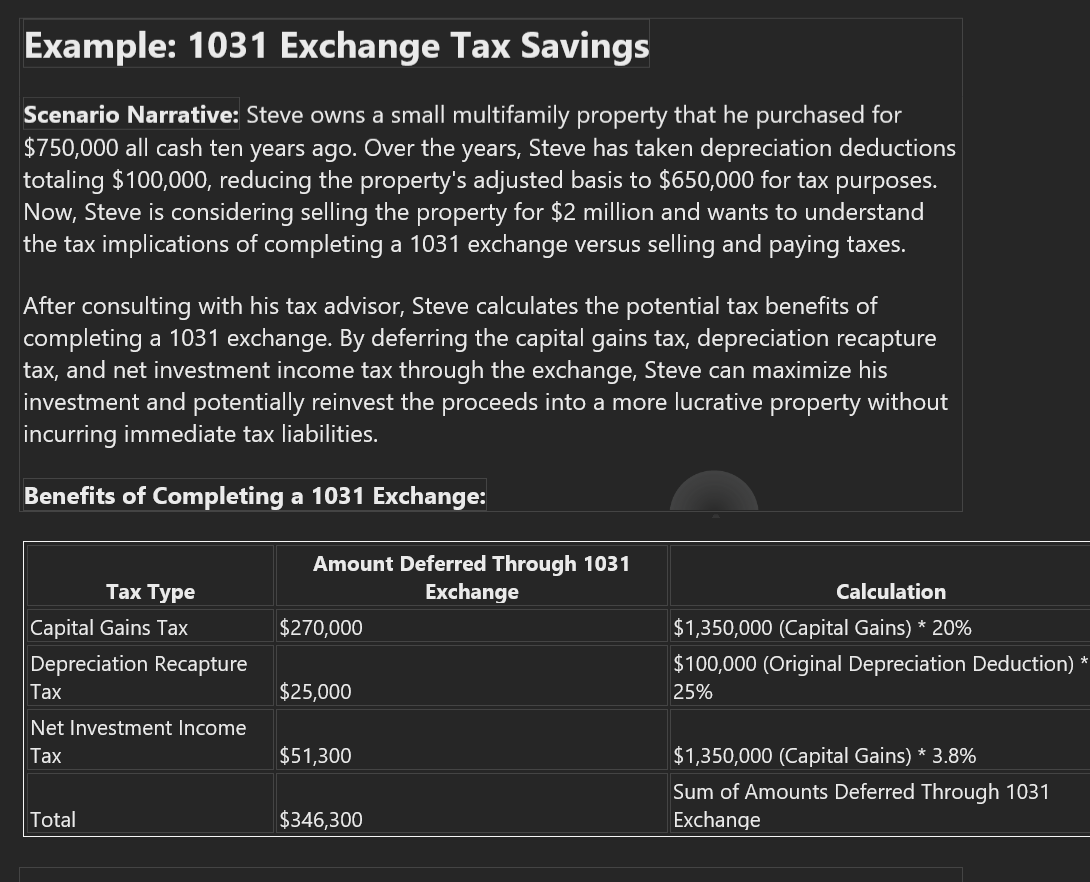

Real-Life Applications Case Studies Demonstrating Successful Outcomes

The world of real estate is abuzz with stories of savvy investors who’ve made a killing through IRC Section 1031 exchanges. But what’s the secret sauce behind their success? Let’s peel back the curtain on these real-life examples and see how they turned tax deferrals into towering profits.

Turning Apartments into Empires

Say you’re sitting pretty with an apartment building that’s appreciated nicely over time. A smart investor once used this as a springboard, swapping it for two high-rise buildings in an up-and-coming district—a classic like-kind exchange transaction. The move wasn’t just about getting more doors; it was strategic positioning for future growth.

In another case, someone had to act fast when they sold their property. By leveraging a qualified intermediary from day one, they stayed clear of IRS pitfalls while shopping around for prime replacement properties—and wrapped things up neatly within the stipulated 180 days.

Navigating Choppy Legislative Waters

You might think changes in tax law would rattle investors—think again. When personal property got kicked off the like-kind eligibility list by the Tax Cuts and Jobs Act, our heroes pivoted smoothly to focus solely on investment real estate—which still sails under the favorable winds of IRC Section 1031 provisions.

A nimble-footed player even leveraged this shift to ditch some old office equipment along with their commercial space—upgrading both through separate transactions but optimizing overall capital gains treatment using effective January strategies outlined by seasoned experts familiar with internal revenue code nuances.

Futures Bright With Strategic Insight

No crystal ball can predict legislative shifts or market tides accurately every time—but that doesn’t stop forward-thinkers from preparing well-crafted game plans based on proposed changes impacting future uses of section 1031 exchanges. They know keeping abreast of potential revisions helps secure advantages others might miss because details matter.

The Taxpayer Bill Of Rights serves as an invaluable compass here.

These are not mere tales; they’re testaments to strategic finesse coupled with deep understanding—an unbeatable combo platter served hot in today’s competitive markets.

Real estate moguls turn properties into empires with smart 1031 exchanges, dodging taxes and reaping big rewards. They stay ahead by using savvy strategies like leveraging intermediaries quickly or adapting to tax law changes. Their secret? Know the rules inside out and always plan for the future.

Decoding Terminology: Key Terms Definitions Within IRS Code

Talking about the Internal Revenue Code (IRC) can sometimes feel like you’re trying to crack an ancient language. But fear not. Let’s unlock some of that cryptic lingo, so when someone mentions a term like like-kind property, you’ll nod with confidence instead of scratching your head.

The Basics of Like-Kind Property

So what’s this whole ‘like-kind’ buzz about? Imagine swapping one toy car for another—no money involved, just straight-up trade. That’s the gist behind IRC Section 1031 exchanges or like-kind exchanges in real estate tax tips. You’re essentially trading one investment property for another and deferring capital gains taxes while doing it.

In plain English, two properties are considered ‘like-kind’ if they’re both used in business or as investments—and yes, we mean real estate here since Aunt Sally’s vintage stamp collection doesn’t cut it anymore after the Tax Cuts and Jobs Act showed up at the party.

Tax Advantages for Real Estate Investors

If you’ve ever felt blue looking at your tax return thinking about capital gains taxes nibbling away at your profits from selling investment real estate—you might want to pay attention here. With a properly structured exchange under IRC Section 1031, those pesky gain taxes could be put on hold indefinitely. Seems pretty awesome, if ya ask me.

Now let’s get something straight; not every piece of dirt qualifies as like-kind real estate—there are rules around what constitutes eligible property held for productive use in business or trade which means personal homes usually don’t make the list unless they double as rental properties.

Navigating The Exchange Process Under IRC Section 1031

You’ve got two major deadlines dancing around these deals—the first is finding a replacement property within 45 days post-handing over keys to your old place; think speed dating but less awkward conversation more scouring listings. Form 8824 spells out all details.

Crack the code of IRC terminology and trade real estate like a pro, deferring taxes with savvy 1031 exchanges. Remember, only investment properties apply—your personal pad won’t cut it unless you rent it out.

Keep an eye on those deadlines: scout your next property fast within 45 days to keep the taxman at bay.

Conclusion

So you’ve walked the path of irc section 1031 and seen how it paves the way for tax-smart real estate moves. You should now grasp why like-kind exchanges are such a game changer, letting investors defer capital gains and reinvest in new opportunities.

You learned about critical timelines—45 days to identify, 180 days to close—and how missing these can derail your exchange. Remember that precision matters; dates aren’t suggestions but hard deadlines set by the IRS.

You uncovered strategies where savvy players use this code not just once but as a repeat play to build wealth over time. It’s a matter of recognizing when to keep going and when to switch into another asset.

And let’s not forget compliance: stickler for details, making sure every T is crossed on those IRS forms ensures smooth sailing through audits or reviews.

Dive deep, stay informed, plan carefully—and watch your real estate portfolio grow while keeping more money in your pocket!