Picture this: you’re on the brink of a real estate deal that could reshape your investment landscape. There’s just one catch — capital gains and depreciation recapture tax is staring you down, ready to take a hefty bite out of your profits. Enter the Section 1031 Qualified Intermediary.

The 1031 Qualified Intermediary (QI), like a financial quarterback deftly navigating the field to score you big savings. They are game-changers in property exchanges, letting investors swap assets without immediate tax hits.

I’ve been there, orchestrating these transactions with finesse. And let me tell ya, it feels like finding an undiscovered shortcut on your daily commute. Stick around and I’ll show you that knowing how to intelligently choose a Qualified Intermediary in a 1031 Exchange can help save you a bundle in taxes.

Table Of Contents:

- Understanding the Role of a Qualified Intermediary in Internal Revenue Code Section 1031 Exchanges

- Step-by-Step Guide to a Successful Section 1031 Exchange Process

- Criteria for Choosing a Reputable Qualified Intermediary

- The Unregulated Landscape of Qualified Intermediaries Industry

- Reverse Exchanges Under Section 1031 Explained

- Impact of Disqualified Persons on Section 1031 Transactions

- Compliance Measures for Secure Section 1031 Exchanges

- FAQs in Relation to Section 1031 Qualified Intermediary

- Conclusion

Understanding the Role of a Qualified Intermediary in Internal Revenue Code Section 1031 Exchanges

Imagine you’re playing hot potato with properties, and the Qualified Intermediary (QI) is your go-to wingman who makes sure you don’t get burned by taxes. In the world of Internal Revenue Code (IRC) Section 1031 exchanges, the QI services are key to swapping investment real estate without taking a tax hit right away.

The Qualified Intermediary’s Function in Tax-Deferred Exchanges

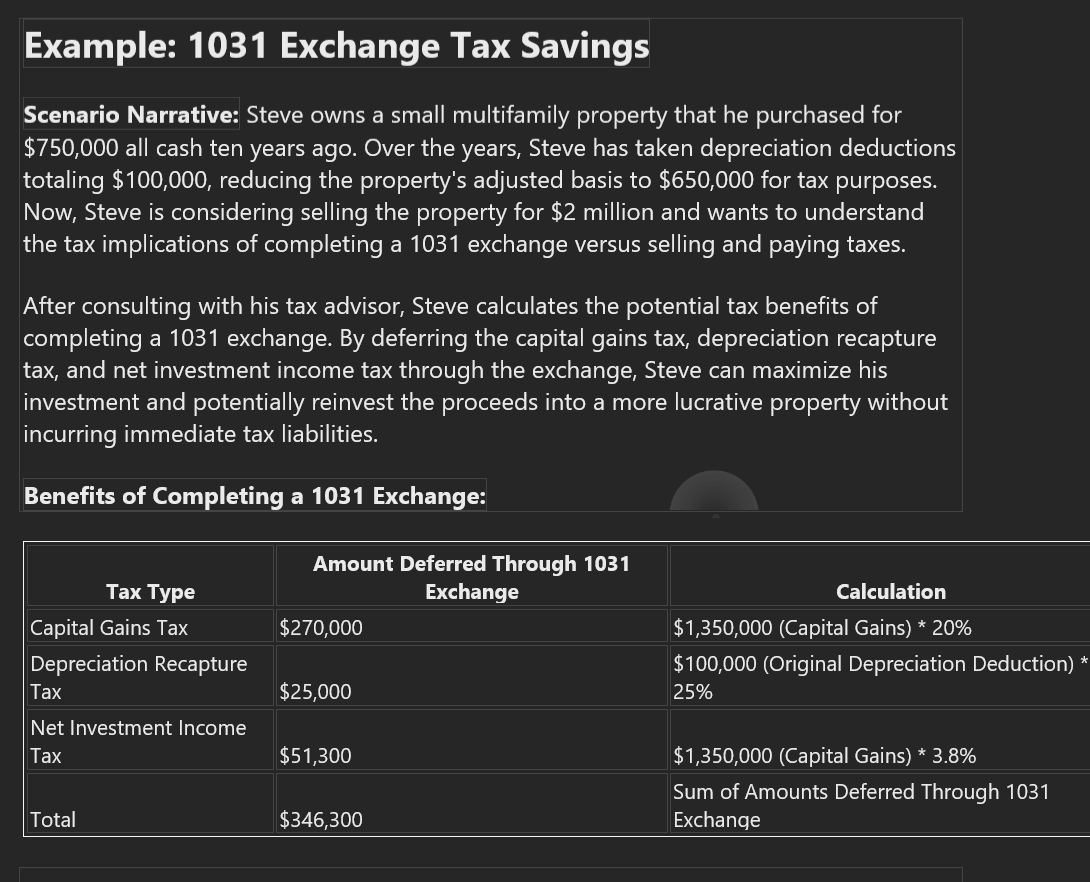

A QI steps into your shoes during an exchange, your qi receives the sale proceeds directly from your relinquished property like it’s their own—because for a brief moment, it legally is. They’ll then buy replacement property on your behalf. It sounds simple but trust me, there’s nothing “qualified” about going at this alone; that’s why nearly 250,000 exchanges are filed annually, reaching values close to $74 billion.

This isn’t just about dodging tax bullets from Uncle Sam—it’s strategic financial maneuvering at its best. The IRS doesn’t play around when they say no “constructive receipt,” meaning if you so much as sniff those sale funds from the sale of your relinquished property before time’s up or mess up timelines set forth by IRC sections governing these moves—you’re looking at hefty penalties instead of sweet tax deferrals.

Importance of QIs in Maintaining IRS Compliance for Exchangers

You wouldn’t walk across a tightrope without some serious safety measures—and similarly, walking through section 1031 needs ironclad compliance frameworks that only seasoned Qualified Intermediary exchange services can provide.

These pros help ensure everything aligns with complex treasury regulations because let’s face it: interpreting federal regulation isn’t everyone’s cup of tea.

Involving one means not having to worry about accidentally hiring disqualified persons—those folks who could make an otherwise perfect exchange null and void because they’re too cozy with parties involved according to the rules laid out under IRC sections defining such roles. The IRS requires that the QI you use has an independent relationship with you- meaning not your accountant, your attorney and not your brother-in-law.

Qualified Intermediaries offer more than peace of mind; they bring expertise ensuring transactions fly smoothly under legal radars while wearing multiple hats—as escrow agents safeguarding exchange funds against misuse and even potentially fraud (let’s not forget investors lost around $250 million due to negligence). So yes, involving them may feel like extra homework—but would you rather do a bit more legwork now or risk dropping millions later?

At Carnegie Wealth Management we can assist in recommending experienced Qualified Intermediaries.

Think of a qualified intermediary as your tax-saving sidekick in 1031 exchange property swaps, handling the tricky bits so you don’t get slapped with taxes or mess up IRS rules. They’re not just there for support; they’re essential to making sure your exchange doesn’t turn into an expensive mistake.

Step-by-Step Guide to a Successful Section 1031 Exchange Process

Identifying Eligible Like-Kind Exchange Properties

The first move in the section 1031 exchange process chess game is spotting your like-kind properties. Now, ‘like-kind’ sounds as broad as the ocean but remember, we’re talking real estate here. You can swap an apartment building for raw land or an office for a strip mall—as long it’s all within U.S borders and held for investment or productive use in business.

Bear this mind: you don’t have to mirror-image your property swap. A residential rental can become commercial space that rivals any boardwalk empire—just make sure they sing the same IRS tune of ‘investment purpose’. But let’s keep it light; after all, even Uncle Sam enjoys a good Monopoly reference now and then.

Finding these gems isn’t just about browsing listings while sipping coffee—it’s more intense than choosing between almond milk or oat milk lattes. You need boots on the ground: savvy real estate brokers who speak fluent tax-deferred language with internal revenue charm.

Navigating Timelines and Deadlines with Your QI

A qualified intermediary (QI) doesn’t juggle fire—but they might as well given how hot those timelines are. They help you play beat-the-clock since from day one post-sale, it’s a sprint against time itself.

Got your running shoes? Good.

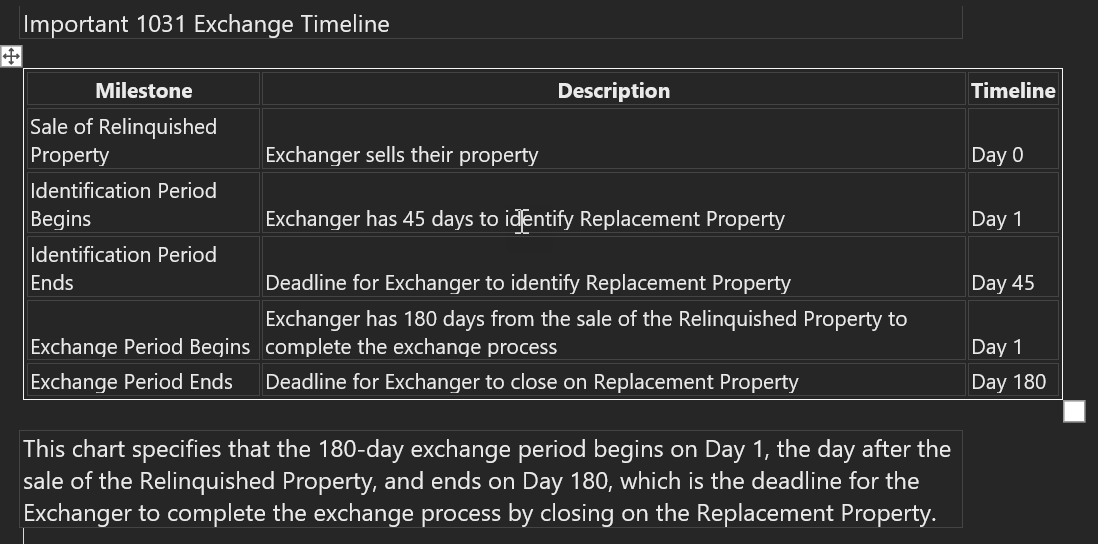

You’ve got exactly 45 days from waving goodbye to your old property (the relinquished one) to tag up to three replacement candidates. Think of this part like speed dating—you want lasting relationships but under serious time pressure.

Then comes another dash towards day 180 when everything must be sealed—the deal signed, escrow accounts closed—and yes folks, not just any Tuesday deadline either; if April rolls around with its income tax demands… consider yourself tagged ‘it’ by calendar rules too.

The Federation of Exchange Accommodators gives us some startling figures — almost $74 billion worth of exchanges annually tells us there are plenty out there mastering these moves.

Remember our friend called compliance? Well sticking close means having every piece documented properly—from written exchange agreements that could rival War & Peace in length—to ensuring title insurance companies do their end-of-deal victory dance right alongside fidelity bond coverage keeping watch.

Now put down that tax advisor hotline number because what really matters is getting this recipe spot-on—a pinch too much constructive receipt spice will spoil the stew.

It’s fascinating to see how, according to IRC regulations, almost 250,000 individuals annually can reshape their assets. They do this without triggering immediate tax consequences—a smart move for savvy investors looking to optimize their financial strategies.

Start your 1031 exchange by finding properties that fit the bill, remembering they must be U.S.-based and for investment. You don’t need an exact match; just stick to the IRS’s definition- investment property for investment property.

Your QI is key in racing against tight timelines—45 days from the time your property relinquished (property sold) to pinpoint potential swaps and 180 days to complete exchange (seal the deal), tax deadlines included. Keep every document on point because one slip can cost you big time.

Criteria for Choosing a Reputable Qualified Intermediary

Finding a dependable qualified intermediary (QI) is like trying to locate a needle in an immense bundle of hay. The stakes are high; remember that back in 2012, investors waved goodbye to an estimated $250 million because of QIs dropping the ball through fraud or negligence.

Due Diligence in Evaluating Potential QIs

Picking a reputable qualified intermediary isn’t just about peace of mind; it’s about protecting your wallet and future. Start by scrutinizing their track record. A solid history speaks volumes more than slick sales pitches ever could. Next up, check their qualifications – do they have skin in the game? Have they been around the block with section 1031 exchanges?

You want someone who can navigate tax-deferred exchanges as easily as ordering coffee at Starbucks—smoothly and without any hiccups. Look into whether they’re well-versed with escrow accounts because you don’t want them fumbling when handling your dough.

Red Flags and Warning Signs to Avoid

Beware if there’s even a hint that your potential QI might be what IRS calls ‘disqualified person’. This is no joke – involving such individuals could send your exchange spiraling down faster than ice cream melting on hot pavement.

If something smells fishy, trust those instincts. It’s better to walk away from an exchange accommodator who gives off bad vibes than stick around only to get burned later. Keep an eye out for murky details regarding fidelity bond coverage or lackluster explanations about routine financial safeguards—they should be able to talk title insurance company jargon fluently while also making sure every penny is accounted for during transactions.

To wrap things up nicely: think of choosing a QI like picking out avocados at the grocery store—you need one ripe enough for immediate use but not so overripe that it goes bad tomorrow. So dig deep into due diligence before committing.

When hunting for a top-notch qualified intermediary, dig into their history and make sure they know the 1031 exchange game inside out. Watch out for red flags like ‘disqualified persons’ or fuzzy details on financial security—they could spell disaster for your investment.

The Unregulated Landscape of Qualified Intermediaries Industry

Picture the Wild West, but instead of outlaws and sheriffs, you’ve got qualified intermediaries (QIs) navigating a frontier barely touched by federal regulation. Now that’s a landscape fraught with both opportunity and risk for investors using section 1031 exchanges. The QI industry has grown into an essential component in these tax-deferred real estate swaps; yet, despite handling exchange funds that are critical to these transactions, it remains largely unmonitored at the national level.

Federal Oversight Absence and Its Consequences

In this no-man’s land of oversight, some states have taken up arms to enact legislation for their own brand of justice—meaning investor protection. But even as nearly a quarter-million exchanges file through annually with values pushing $74 billion sky-high—a nod to the vastness of this terrain—there’s no universal sheriff in town.

What does this signify for your precious funds? Well, imagine you’re playing poker without knowing if the dealer plays fair—it could go well or… not so much. Without consistent federal scrutiny across all state lines, we rely on trust more than many would prefer when choosing who holds our sale proceeds during an exchange process.

To say there’s room for improvement is like saying cacti are kind of prickly—it’s quite an understatement. For instance,

- No unified rules governing how escrow accounts should be managed can lead folks down a risky path faster than horses running from thunder.

- Lackluster fidelity bond coverage might leave investors exposed just like wearing shorts during a snowstorm—not ideal.

- If someone disqualified gets their mitts on your dough due to vague definitions around “constructive receipt,” well then partner—you’ve got trouble brewing hotter than black coffee over campfire coals.

We ain’t whistlin’ Dixie here—the lackadaisical approach means it falls squarely on exchangers’ shoulders to vet QIs like they’re gold prospectors sifting through river silt hoping for nuggets big enough to retire on. And although treasure hunts sound fun in theory—who wants one tied with red tape?

At Carnegie Wealth Management we can assist in recommending experienced Qualified Intermediaries.

Imagine the Wild West of real estate exchanges, where without strict laws, picking a trustworthy qualified intermediary is like searching for gold—risky but necessary. It’s high time this industry saw some law and order.

Reverse Exchanges Under Section 1031 Explained

Imagine you’re seated at a fancy dinner, and your gaze has been drawn to the ideal dessert. But there’s a catch: You can only snag that sweet treat if someone else wants your untouched appetizer. That’s the essence of reverse exchanges under section 1031—except we’re talking properties, not pastries.

Defining Reverse Exchanges in Property Swaps

A reverse exchange is like doing a backflip in real estate gymnastics; it lets investors acquire replacement property before selling their current asset. This acrobatic feat provides flexibility when timing is as tight as skinny jeans from two seasons ago.

In this advanced strategy, an Exchange Accommodation Titleholder (EAT) temporarily holds title to one of the properties involved in the transaction. It’s akin to having a stunt double step into action during complex movie scenes—the EAT swoops in so you don’t face constructive receipt issues with Uncle Sam watching closely for any tax mishaps.

To pull off this maneuver without pulling something important, here are some nifty tidbits:

- You have up to 180 days after acquiring your new trophy asset to wave goodbye to the old one—like saying “Ciao.” while boarding your yacht bound for newer horizons.

- Your Qualified Intermediary (QI) becomes more than just an intermediary—they’re now choreographers orchestrating each meticulous move between assets within stringent IRS guidelines and deadlines including extensions where applicable.. So pick wisely.

- The beauty lies in being able to lock down hot-to-trot real estate even if yours hasn’t hit market tango yet—but remember these deals need precision planning sharper than cutlery at said fancy dinner party.

New York State Society of CPAs, sheds light on how navigating through treacherous waters sans regulation requires experienced captains—a.k.a QIs—who won’t steer your investment ship aground.

Beware though; this isn’t child’s play or monopoly money at stake. A failed exchange could leave investors’ wallets emptier than a hermit’s address book—and let’s not forget about those savvy scammers lurking behind fake escrow accounts ready to pounce faster than cats on laser pointers. Keep eyes peeled wider than an owl hopped up on espresso shots for signs of fraudulence that might turn dreams sour quicker than milk left out overnight.

If done right, however, these reversals can turn into sweet victories. They give exchangers the upper hand—like kids who get first pick of the candy stash.

Think of reverse exchanges like a real estate backflip, giving you the chance to grab new property before selling the old. But it’s tricky and needs a sharp Qualified Intermediary to choreograph your moves within IRS rules. Mess up, and it could cost you big—so watch out for scams.

Impact of Disqualified Persons on Section 1031 Transactions

If you’re thinking about a section 1031 exchange, it’s crucial to know who might throw a wrench in your plans. Enter the ‘disqualified person’. This is someone so close to the deal they could taint the whole process.

Recognizing Parties that Could Jeopardize Your Exchange

The last thing you want during an exchange is for Uncle Sam to cry foul because your mom or best friend was the one responsible for your funds held in an escrow account. But why? Well, certain folks are just too close for comfort—like relatives and people who’ve had a financial relationship with you within two years of the transaction.

They can sway decisions in ways that break federal regulation guidelines designed to keep things fair.

A disqualified person’s impact on section 1031 transactions isn’t small potatoes—it can nullify all those sweet tax deferrals you were counting on. Imagine going through all those steps: choosing like-kind property, playing beat-the-clock with IRS deadlines, only to have it fall apart because you didn’t double-check who’s holding onto your sale funds.

Here’s where our trusty qualified intermediaries (QIs) come into play—they’re kind of like Gandalf guiding Frodo in “The Lord of the Rings”, but instead of fighting off Orcs, they protect us from taxable events and compliance mishaps. These QI wizards ensure no disqualified persons touch our treasure—or rather, our real estate proceeds—and keep us safely within IRC sections’ labyrinthine rules governing exchanges.

To sidestep potential drama and safeguard against any missteps along this high-stakes journey called property swapping:

- Vet Your Team: Make sure anyone touching your money—from investment bankers down to real estate brokers—isn’t related or hasn’t provided services related directly or indirectly towards personal taxes recently; we’re talking about steering clear from situations ripe for constructive receipt nightmares.

- Tighten Escrow Security: You don’t want a repeat performance by companies like LandAmerica which left investors hanging back in ‘08 due simply poor management—a solid title insurance company will help prevent these issues before they start brewing trouble under their watchful eyes.

- Kiss Up To Compliance Measures: Having rock-solid written exchange agreements are more than just good paperwork—they’re lifesavers when facing down auditors armed with Treasury regulations thicker than War & Peace. Plus keeping fidelity bond coverage up-to-date means even if something goes sideways—you’ve got backup ready spring into action faster than Batman answering Gotham’s call (or at least give some peace mind).

In short? Stay on top of these rules and you’ll be set. Constructing material that appears individualized, is effortless to understand, and truly useful. Now go ahead, craft something great.

Watch out for disqualified persons in 1031 exchanges—they can spoil your tax breaks. Make sure your money handlers, like investment bankers and real estate brokers, aren’t too close to home or have recent financial ties with you.

Secure a good title insurance company to prevent management mishaps and stay tight with compliance—solid exchange agreements and updated fidelity bonds are must-haves.

Compliance Measures for Secure Section 1031 Exchanges

Securing your hard-earned investment during a section 1031 exchange is no joke. You’re playing in the big leagues where one misstep can cost you more than just sleepless nights. Remember when LandAmerica hit rock bottom in 2008? Around 400 investors felt that punch right in their portfolio, learning the hard way about the importance of having iron-clad compliance measures.

Ensuring Security Through Proper Escrow Management

To dodge such nightmares, savvy investors put their trust into escrow accounts managed by qualified intermediaries (QIs). Not all QIs are alike; some provide better protection than others. We’re talking about a space as tightly secured as Fort Knox because these folks don’t just hold onto your sale proceeds; they protect them like a mama bear guarding her cubs.

You might be thinking: “But wait, aren’t there federal regulations overseeing this whole shindig?” Surprise. The industry runs wilder than an unchaperoned spring break since it’s not federally regulated—though some states have stepped up to bat with legislation for oversight.

A top-notch QI will safeguard those funds under strict fidelity bond coverage and lay down an impenetrable fortress against constructive receipt claims from Uncle Sam’s tax collectors at Internal Revenue Service. Because let’s face it, if they sniff out even a hint of foul play or mishandling within your exchange transaction—you could kiss those sweet tax deferrals goodbye faster than ice cream melts on a hot sidewalk.

If we peek behind the curtain of routine financial transactions involved in property exchanges, there’s more drama than daytime TV when things go south due to fraud or negligence by intermediaries looking to make quick bucks off unsuspecting exchangers’ assets.

To ensure you’re pairing up with the real deal and not some two-bit hustler posing as an investment banker or estate broker masquerading around with fancy titles without proper structure – do yourself a favor and ask for proof of comprehensive bond coverage before signing any written exchange agreement.

By securing seasoned professionals equipped with treasury regulations knowledge like Tom Brady knows football plays – you’ll get that peace-of-mind feeling knowing someone skilled has got your back through every step from relinquished property handoff till replacement property received touchdown.

Don’t leave anything up to chance—or worse yet—to disqualified persons who could torpedo everything faster than you can say “tax return.” So choose wisely; because selecting an ace intermediary isn’t just smart—it’s essential. Here’s a resource that dives deeper into why the right choice matters and how it can make or break your financial strategies.

Picking the right Section 1031 qualified intermediary is like choosing a quarterback for your financial team. They must protect your investment and play by the rules, or it’s game over for those tax breaks.

Don’t get blindsided—demand proof of bond coverage from your QI to shield against mishaps and keep Uncle Sam at bay.

FAQs in Relation to Section 1031 Qualified Intermediary

Who is a qualified intermediary in a 1031 exchange?

A qualified intermediary is the middleman who holds funds during your property swap to keep it IRS-compliant.

How much does a qualified intermediary 1031 cost?

Fees vary widely; you might shell out anywhere from $600 to several thousand, depending on deal complexity.

What is the purpose of the qualified intermediary?

Their role ensures your real estate transaction meets strict tax-deferral rules under Section 1031 regulations.

What is a qualified intermediary agreement?

This contract lays down terms between you and the QI, detailing their duties for your tax-deferred exchange.

Conclusion

Wrapping up, you’ve seen how a section 1031 qualified intermediary can be your tax-deferring MVP. They hold the keys to like-kind exchanges and keep those capital gains taxes at bay.

You now know that choosing the right QI matters. Ask the tough questions; dig deep into their experience and security measures.

Remember, state laws vary; some are strict, others lax. So do your homework on regulations where you’re dealing real estate.

Consider reverse exchanges for more flexibility in snagging that perfect property. And always steer clear of disqualified persons — they’re exchange kryptonite.

To sum it up: Maximize savings, dodge common hurdles with pros’ help, and work with trusted intermediaries to come out ahead in the complex game of real estate investing.