Let’s dive into the world of tax code 1031 exchange, a game-changer for real estate investors aiming to defer capital gains, depreciation recapture and Net Investment Income taxes. Employing this tactic transcends merely sidestepping upfront tax liabilities; it paves the way for funneling resources into similar assets, thus magnifying your potential fiscal growth prospects without the financial strain imposed by cumulative taxation.

Here, you’ll get the lowdown on how the tax code 1031 exchange provision works, who benefits most, and why understanding its nuances could mean more money in your pocket.

We’ll walk through each step needed to nail a successful exchange—from identifying eligible properties to finalizing deals within IRS timelines. Plus, we touch on leveraging Delaware Statutory Trusts (DSTs) for those looking at hands-off investments. So buckle up; by the end of this read, you’ll be primed with knowledge ready to turn property exchanges into profitable ventures.

Table Of Contents:

- Understanding the Basics of Tax Code 1031 Exchange

- Benefits and Strategic Advantages of 1031 Exchanges

- The Step-by-Step Process of Conducting a 1031 Exchange

- Navigating Capital Gains Implications with 1031 Exchanges

- DST Option – A Gateway to Institutional Quality Real Estate Investment

- The Role of Depreciation Recapture in Your Tax Strategy

- Tackling Common Challenges in Like-Kind Exchanges

- Integrating Real Estate Investment Strategies with Tax Planning

- Conclusion

Understanding the Basics of Tax Code 1031 Exchange

The magic behind deferring capital gains, depreciation recapture and net investment income taxes in real estate investing often lies within a somewhat mystical section of the Internal Revenue Code known as tax code 1031. At its core, this rule allows investors to postpone paying capital gains tax on an investment property by reinvesting the proceeds into another like-kind property. But it’s not just any switcheroo; there are specific criteria and types of properties involved.

A key aspect that every savvy investor should know is that like-kind exchanges have been a part of our tax landscape for more than 100 years, offering powerful protection against immediate tax liabilities. However, thanks to changes brought about by the Tax Cuts and Jobs Act, only real property qualifies for this treatment now—so saying goodbye to trading your apartment building for a shiny new airplane today.

To dig deeper into how you can leverage this provision without getting tangled up in IRS red tape, consider browsing through Like-Kind Exchanges – Real Estate Tax Tips. This resource breaks down essential information such as identifying what constitutes like-kind property (hint: it’s broader than you think) and understanding which swaps make financial sense when aiming to defer paying those pesky gains taxes.

In essence, mastering the 1031 exchange isn’t just about dodging bullets from Uncle Sam—it’s an artful dance with regulations that can significantly boost your investment strategy if performed correctly. Remember though, while exchanging real estate might sound straightforward on paper, each step from selection to finalization has rules tighter than skinny jeans at Thanksgiving dinner—miss one deadline or misinterpret ‘like-kind’, and you could face unexpected consequences – paying the taxes.

Benefits and Strategic Advantages of 1031 Exchanges

Portfolio Diversification Through Like-Kind Exchanges

Diving straight into the heart of real estate investment strategies, let’s talk about how a 1031 exchange can be your golden ticket to diversifying your portfolio. Before the Tax Cuts and Jobs Act came along, investors had the flexibility to swap both personal property and real property under like-kind exchanges. Currently, the focus has shifted entirely to real property assets.

But don’t think this narrows down your options; if anything, it sharpens them.

This change means you’re looking at swapping an apartment building for another type of investment property or even something as different as raw land—as long as it’s within the realm of real estate. The key here is that by exchanging one kind of investment real estate for another, you’re not just deferring capital gains taxes temporarily; you’re also potentially stepping into higher-yielding investments or markets with more growth potential.

The magic lies in leveraging powerful protection against market volatility while keeping those pesky capital gains taxes at bay—temporarily, anyway. Imagine moving from a slow-growth area to a booming city without handing over a chunk of your profits to Uncle Sam first. This approach transcends mere tax savings, embodying wise decisions poised to amplify future gains significantly.

The Step-by-Step Process of Conducting a 1031 Exchange

Identifying Replacement Property

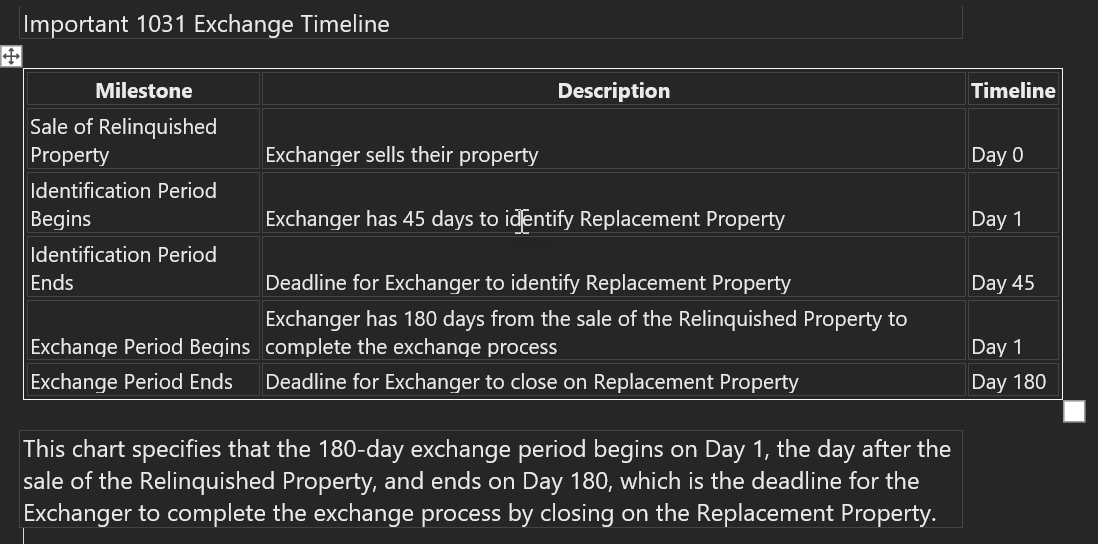

Finding the right replacement property is like trying to hit a moving target with your eyes closed, but knowing you have exactly 45 days from selling your relinquished property. In this brisk window, swift and astute actions are paramount. You can look into various types of real estate, as long as they qualify under IRS guidelines for like-kind exchanges.

Keep in mind, sidestepping capital gains tax is only one piece of the puzzle; it’s equally crucial to ensure your next venture mirrors your ambitions.

Your options aren’t limited to apartment buildings or commercial spaces; any real estate used for business or investment purposes might fit the bill. The IRS definition of like-kind real estate is fairly broad. Think investment real estate for investment real estate.

That means primary residences wouldn’t generally fiit.

The key here is ensuring that whatever you pick meets the fair market value criteria and serves as an equivalent exchange in terms of utility and value.

Finalizing the Exchange

Closing on a replacement property within IRS timelines isn’t just advisable—it’s mandatory if you want to defer paying capital gains taxes effectively. With only 180 days after selling your original asset, every second counts towards securing your financial future without burdening it with immediate tax liabilities.

To cross this finish line successfully, meticulous paperwork preparation becomes paramount. From contract negotiations down to final closing documents, make sure everything reflects that both properties involved are part of a strategic move designed to benefit from Section 1031’s provision within the Internal Revenue Code—this includes stating clearly how each step was made solely for investment purposes.

This journey requires precision planning and flawless execution because slipping up could mean missing out on significant tax savings benefits afforded by properly leveraging these complex yet rewarding exchange rules.

Navigating Capital Gains Implications with 1031 Exchanges

Imagine selling your investment property and not having to pay capital gains tax immediately. That’s the beauty of a 1031 exchange. Under IRC Section 1031, investors can defer paying these taxes by reinvesting the proceeds into like-kind real estate.

Adopting this approach is not merely a tactic to postpone tax payments; it cleverly allows one to expand their portfolio while sidestepping the upfront economic burden associated with capital gains, depreciation recapture or net investment income taxes. But, there are rules to play by. The exchanged properties must be used for business or investment purposes only, and you’ve got timelines to adhere to—identify replacement property within 45 days and close within 180 days.

Diving deeper, let’s talk about diversification through Delaware Statutory Trusts (DSTs). A DST allows you to invest in high-quality real estate indirectly, offering another layer of strategic flexibility within the realm of 1031 exchanges. It enables passive involvement in institutional-grade properties without dealing with day-to-day management hassles.

But here comes depreciation recapture—a potential curveball. When you sell an asset at a gain after claiming depreciation deductions on it, Uncle Sam wants a piece of that action too through what’s called depreciation recapture taxed as ordinary income up until certain limits.

The bottom line? Navigating the waters of a successful 1031 exchange demands understanding its intricacies—from leveraging DST options for diversification to considering implications like depreciation recapture on your overall tax strategy.

Carnegie Wealth Management can answer your 1031 Real Estate Questions/Concerns.

DST Option – A Gateway to Institutional Quality Real Estate Investment

Delaware Statutory Trusts (DSTs) provide an intriguing alternative within the 1031 exchange landscape, granting access to premium real estate opportunities minus the direct oversight usually required. This option is not just about deferring capital gains taxes; it’s about opening doors to properties that were once out of reach.

For those looking into DSTs as an investment vehicle, passive involvement is one of its most appealing features. It lets you be part of significant real estate ventures without dealing with the day-to-day operations. Think big apartment buildings or sprawling commercial spaces or even building on lease to the US Government—properties that offer potentially attractive returns but require deep pockets and extensive expertise to manage.

The Internal Revenue Code has recognized like-kind exchanges for quite some time, enabling savvy investors to defer capital gain taxes effectively. IRC Section 1031 lays down this framework, which DST investments fit snugly within. By pooling resources with other investors under a trust structure, individuals can get a slice of institutional-grade real estate pie—a move that was nearly impossible before DSTs came into play.

By leveraging this creative strategy, you’re not only sidestepping the immediate fiscal hurdles but also broadening your investment horizon to span various industries and regions. Imagine having interests in both a Medical Office complex in New York and Triple Net Lease retail space in California simultaneously—all while sitting back and letting professional managers take care of business.

In essence, Delaware Statutory Trusts redefine what’s possible within the confines of traditional property investing strategies by combining tax efficiency with access to premier properties—all underlined by the simplicity of passive participation.

For Answers to your 1031 Questions

239-898-8918– Speak with a live 1031 Specialist

carnegiewealth@earthlink.net

The Role of Depreciation Recapture in Your Tax Strategy

Imagine selling an investment property and facing a tax bill higher than expected, all because of depreciation recapture. This sneaky little concept plays a big role in the taxes you owe when leveraging a 1031 exchange to defer capital gains. However, grasping the mechanism behind it can morph this looming nuisance into a cleverly wielded asset.

Depreciation allows real estate investors to deduct the costs associated with buying and improving a rental property over its useful life, effectively reducing taxable income each year. However, when you sell that asset for more than its depreciated value (basically any sale above zero if fully depreciated), Uncle Sam wants a piece of that action through what’s known as depreciation recapture.

Depreciation Recapture Tax Deferred:

- Depreciation Recapture = Original Depreciation Deduction (Depreciation Schedule).

- Let’s assume an original depreciation deduction of $100,000 over 10 years.

- Depreciation Recapture Tax Deferred = Original Depreciation Deduction * Depreciation Recapture Tax Rate.

- Depreciation Recapture Tax Deferred = $100,000 * 25% = $25,000.

To sum up: yes, depreciation recapture can take a bite out of your profits when selling real estate investments used for business or production purposes under current IRS rules—unless it’s part of an astutely planned 1031 exchange strategy which considers both capital gains and recaptured depreciation implications upfront. So before making your next move, make sure you understand not just how to defer paying those capital gains but also how to smartly navigate around the less-talked-about pitfall: depreciation recapture.

Tackling Common Challenges in Like-Kind Exchanges

Like-kind exchanges, a cornerstone of savvy real estate investing, come with their own set of hurdles. But fear not. We’re here to guide you through these obstacles like a pro.

The first challenge many face is understanding what “like-kind” refers to exactly. It’s not about swapping an apple for an orange but rather exchanging one investment property for another that serves a similar purpose or function in your portfolio. Navigating this may seem straightforward, yet the IRS imposes stringent criteria on which properties qualify.

So before you leap into what seems like an attractive deal, make sure it qualifies under IRS guidelines.

Another common pitfall? Timing issues can catch even seasoned investors off guard. You’ve got 45 days post-sale of your original asset to identify potential replacement properties and up to 180 days to close the deal on one of them. Miss these deadlines, and say goodbye to those tax deferment dreams.

Finding suitable replacement property within this timeframe requires diligence and often, professional help from a real estate broker who understands the intricacies of 1031 exchanges inside out.

Let’s also talk paperwork – because there’s plenty of it involved in these transactions. Ensuring accurate documentation is critical; any slip-ups could lead the IRS right to your doorstep with questions or worse – penalties.

In summary (though we said we wouldn’t use that phrase), while like-kind exchanges offer fantastic opportunities for deferring capital gains taxes and repositioning assets within your portfolio, they’re not without challenges. Navigating them successfully means doing homework beforehand, staying organized throughout, and possibly enlisting some expert guidance along the way.

Integrating Real Estate Investment Strategies with Tax Planning

Real estate investment strategies and tax planning might seem like two separate worlds, but when they collide under the right conditions, magic happens. Specifically, we’re talking about leveraging IRC Section 1031 to its fullest potential. This savvy move can transform your real estate game from good to great.

Diving deep into the realm of IRC Section 1031 Internal Revenue Code, it’s clear why astute investors perk up at its mention. By allowing the deferral of capital gains taxes on exchanged properties used for business or investment purposes only, this provision is a golden ticket for those looking to reinvest without immediately losing a chunk of their profit to taxes.

The trick lies in understanding that not just any property swap will do; both relinquished and acquired assets must be considered “like-kind.” While this term may sound broad, post-Tax Cuts and Jobs Act restrictions clarify that only real property qualifies—so long dreams of swapping an apartment building for a rare painting collection as part of your diversified portfolio strategy.

Exploring a Delaware Statutory Trust (DST) offers an alternative path in these exchanges, weaving through the intricacies of real estate investments. Delving into a Delaware Statutory Trust (DST) paves the way for investors to dip their toes in top-tier real estate projects, sidestepping the usual hassles of direct property management.

For many investors, DSTs represent not just diversification but also access to markets previously out of reach due to financial or logistical barriers.

Beyond immediate tax deferment perks lie deeper strategic advantages such as depreciation recapture considerations and navigating net investment income tax implications—all essential elements in crafting a robust investment approach tailored around individual goals and market realities.

Conclusion

So, we dove deep into the tax code 1031 exchange. You learned it’s not just a way to defer taxes associate with an outright sale, but a strategy to grow your investments.

Key takeaway? Trading properties of similar nature lets you postpone paying taxes on profits, enabling you to channel those funds into acquiring pricier properties.

We walked through identifying eligible properties and closing deals within IRS guidelines. Keep in mind, the key to pulling off a successful swap lies in nailing the timing just right.

Exploring DSTs opened doors to passive investment opportunities in high-quality real estate. This means even hands-off investors can benefit from these exchanges.

To wrap up: The tax code 1031 exchange offers powerful protection for your profits. With patience and strategic planning, you’re set to maximize returns without the immediate cash hit from capital gains taxes.

Dive in with confidence; this knowledge is now yours to leverage for smarter investments.