Imagine unlocking a strategy that lets real estate investors swap properties without the immediate hit of capital gains, depreciation recapture and Net Investment Income taxes. That’s what is a 1031 exchange. This tax-deferred lifesaver isn’t new, but it’s still one of the smartest plays in the property game.

It’s like passing ‘Go’ in Monopoly and collecting $200, except here, you’re deferring taxes while potentially upgrading your investment portfolio.

We’re diving deep into how this process of what is a 1031 exchange can defer those pesky capital gains and depreciation recapture taxes and keep more money in your pocket for your next real estate investment. From replacing an old apartment building with a shiny new triple net lease retail commercial space to swapping land for a— Senior Living Apartment Complex – these rules could be pure gold.

You’ll get savvy about identifying like-kind properties and why timing is everything when chasing down 1031 replacement property gems. And if paperwork makes you sweat, don’t worry; we’ve got tips on navigating IRS Form 8824 too. So buckle up; we’re setting off on a journey through the twists and turns of real estate’s golden ticket— so get ready to understand what is a 1031 exchange process.

Table Of Contents:

- The Fundamentals of a 1031 Exchange – What’s a 1031 Anyway?

- Qualifying Properties and Like-Kind Exchanges

- Navigating the Process with Qualified Intermediaries

- Reporting Your Exchange to the IRS

- Timing Constraints and Identification Rules

- Case Studies Demonstrating Effective Use of Exchanges

- Advanced Strategies Involving Section 1031 Exchanges

- Additional Considerations Before Initiating an Exchange

- Conclusion

The Fundamentals of a 1031 Exchange – What’s a 1031 Anyway?

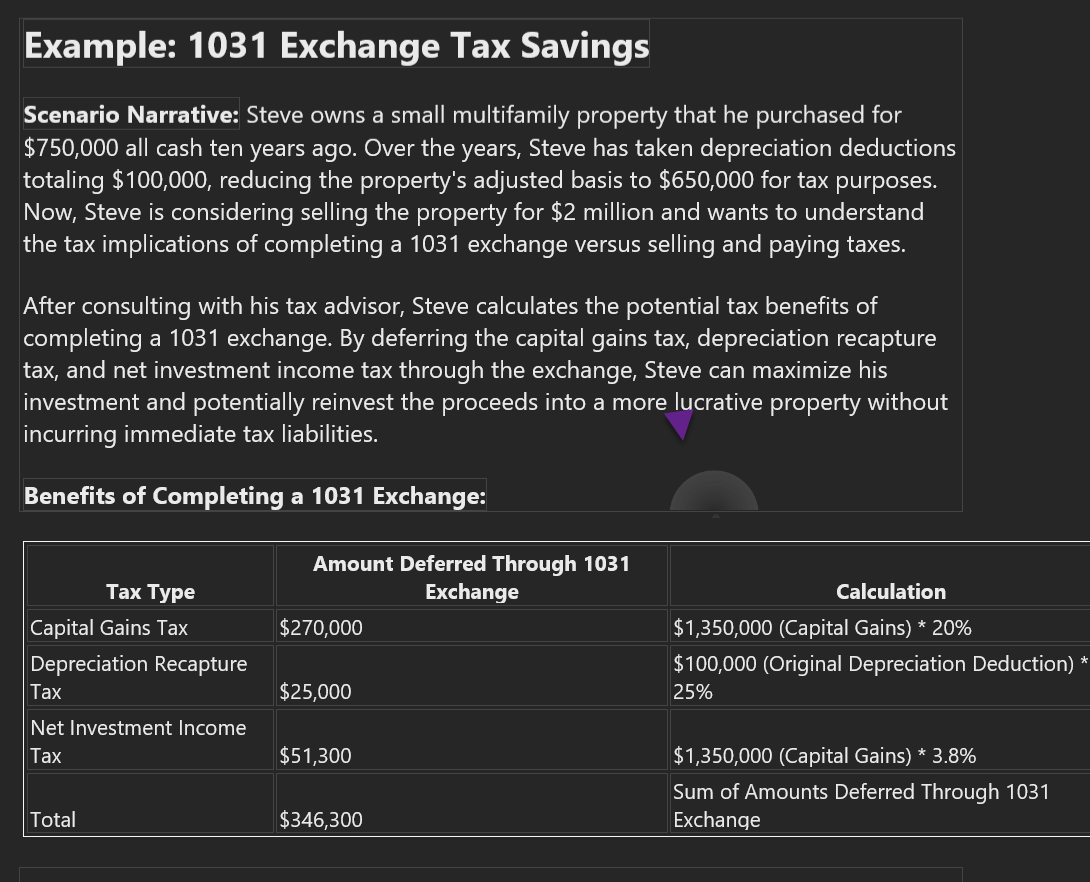

Imagine playing a game of financial hot potato with real estate, where the goal is to pass along all the taxes associated with the sale to your future self. That’s the core concept behind what is a 1031 tax deferred exchange in the investment property playground. This IRS-approved strategy lets you swap one investment property for another and defer paying capital gains taxes on any profit—a move that could be likened to upgrading from coach to first class without extra cost at tax time.

Defining What is a 1031 Exchange and Its Objectives

A 1031 exchange gets its name from Section 1031 of the Internal Revenue Code, which allows investors to reinvest proceeds from sold investment properties into new ones while deferring all immediate capital gains, depreciation recapture and Net Investment Income taxes. It’s like-kind exchanges made easy—swap an apartment building for a Medical Office complex or raw land, provided they’re both in Uncle Sam’s territory and meet certain criteria.

The purpose? To stimulate economic growth by encouraging reinvestment while giving real estate moguls some breathing room against hefty tax hits.

This isn’t Monopoly money we’re talking about; it’s tangible assets moving within strict timelines laid out by IRS rules. If done right, investors can grow their portfolios significantly more than if they had paid out those pesky gains taxes each step of the way.

Key Benefits for Real Estate Investors

The beauty of this arrangement lies not just in delaying tax liability but also preserving cash flow which can then be leveraged into more substantial investments—or simply kept aside as dry powder waiting for golden opportunities.

Reporting such maneuvers properly through Form 8824 ensures smooth sailing when navigating these waters with Uncle Sam’s watchful eyes upon you. Just remember: details matter here since accurate reporting equals compliance peace-of-mind come audit season.

To maximize benefits—and minimize headaches—it’s essential that transactions are managed by someone who knows their stuff; enter Qualified Intermediaries (QIs) whose sole job is holding onto sale proceeds during transitions (you know, because touching cash directly would burst our whole ‘deferred’ bubble).

Carnegie Wealth Management can refer experienced and knowledgeable Qualified Intermediaries.

Think of a 1031 exchange as the ultimate real estate upgrade without the immediate tax bill. It’s a savvy move that lets you swap properties, save on taxes now, and invest more of your sale proceeds back into your portfolio.

Getting it right means meticulous timing and smart reporting—get expert help to keep Uncle Sam happy.

Qualifying Properties and Like-Kind Exchanges

So, you’ve got an eye on a shiny new investment property but dread the capital gains tax from selling your old one? Enter stage left: the 1031 exchange. It’s like swapping baseball cards as kids—trade one for another without cash changing hands, keeping Uncle Sam’s mitts off your money… for now.

Understanding ‘Like-Kind’ Property Criteria

‘Like-kind’ might sound like something out of a Dr. Seuss book, but in real estate terms, it’s pretty straightforward. Think of it this way: You can trade an apartment building for raw land or a Medical Office complex because they’re all real property under Section 1031 of the Internal Revenue Code. But don’t get too wild—the IRS isn’t going to let you swap that duplex for a sports car.

What kind of properties qualify for a 1031 exchange?

The types of properties that qualify for a 1031 exchange are vast yet specific; both relinquished and replacement properties must be held for business or investment purposes to play ball in this game. This is where savvy investors sidestep hefty capital gains and depreciation recapture taxes by sticking within these rules—and yes, even certain leasehold interests with at least thirty years remaining on them can join the party.

To make sure everything is up to code with Uncle Sam when trading places (or rather properties), consult Form 8824. This form will walk you through reporting your exchanged property details so accurately; not even Sherlock Holmes could find fault.

But remember folks, timing is as crucial here as comedic delivery is to stand-up—it’s no joke. Once you wave goodbye to your old property friend (relinquished property), the clock starts ticking—you’ve got precisely 45 days to spotlight potential replacements and shine those options onto the IRS Form identification list stage; then wrap things up tight within 180 days before the curtains close on this act.

No need for stress-induced ice cream binges though—if replacing multiple props sounds more daunting than finding Waldo at a candy cane convention—relax. A single sale can lead into various acquisitions; just make sure each fits the ‘like-kind’ bill neatly inside the set time frames provided by our good ol’ tax overlords at the Internal Revenue Service…

Think of a 1031 exchange as your tax-deferral ace up the sleeve—swap properties, defer capital gains taxes and play by IRS rules. Just remember, like-kind means investment real estate for investment real estate, and you’ve got strict timelines to follow—45 days to identify, 180 to seal the deal.

Navigating the Process with Qualified Intermediaries

Think of a qualified intermediary (QI) as your 1031 exchange compass. They guide you through the maze of rules and regulations, making sure you don’t hit any dead ends. Choosing an experienced QI is not just smart; it’s essential to ensure that every step from sale to purchase ticks like clockwork.

Selecting Your Intermediary Wisely

The role a qualified intermediary plays in a 1031 exchange can make or break your investment goals. It’s like picking a quarterback for your football team – they need to have experience, knowledge, and reliability under pressure. So how do you spot the Tom Brady of intermediaries?

Look for someone who has successfully navigated complex exchanges before and comes highly recommended by other real estate investors and 1031 real estate brokers.

Your chosen QI will handle all transaction details including holding sale proceeds in escrow—a vital part in maintaining tax-deferred status according to Internal Revenue Code guidelines Form 8824. Think about it: You wouldn’t trust just anyone with your playbook on game day, so why risk it when there are potential capital gains taxes at stake?

A savvy investor knows that choosing wisely means less worry down the line because their property purchased meets stringent IRS criteria without hiccups—leaving them free to focus on future investments rather than fixing costly errors post-exchange.

So let’s put this into perspective: When tackling something as intricate as real estate transactions involving relinquished properties and replacement properties within strict timelines—the last thing you want is uncertainty about whether each move complies with IRS regulations or if gains taxes could sneak up on you unexpectedly. With stakes high and time short, getting expert help isn’t just nice—it’s non-negotiable.

Reporting Your Exchange to the IRS

Filing taxes can feel like navigating a labyrinth, but when it comes to 1031 exchanges, precision is your best friend. Let’s say you’ve swapped one investment property for another and want Uncle Sam to give you a nod of approval. You’ll need Form 8824 in hand – it’s the GPS guiding you through tax deferral territory.

Completing Tax Documentation Accurately

The last thing any real estate investor wants is an audit because of sloppy paperwork. That’s why reporting your exchange with laser-like accuracy on IRS Form 8824 isn’t just good practice; it’s crucial for keeping your capital gains tucked away safely in their tax-deferred bed. This form becomes part of your tax return and tells the tale of both properties involved—where they lived, how much they were worth, and how they found new owners.

The beauty here? The Internal Revenue Code Section 1031 allows real estate investors to delay paying capital gains, depreciation recapture and Net Investment Income taxes if they reinvest proceeds from the sold property into like-kind replacement property within set time frames—swap till you drop. But don’t get too carried away; missing deadlines or messing up details will have consequences more severe than forgetting a loved one’s birthday.

Your intermediary might be as essential as coffee on Monday morning since these pros handle all transaction aspects securely while holding sale proceeds in escrow—a financial babysitter who doesn’t let anyone touch the cookie jar until it’s time.

To keep things crystal clear for our friends at the IRS (because who doesn’t love clarity?), report each detail meticulously: describe exchanged properties and any cash received during transactions—even that extra money that felt like finding change under couch cushions must be declared.

Breathe easy knowing there are no tricks up these sleeves; following rules leads to smooth sailing—or exchanging—in this case. So dot those i’s, cross those t’s, file everything timely alongside your regular returns—and voila. You’re not just compliant—you’re confidently ahead of the game without owing immediate gains taxes.

Filing taxes? Nail it with Form 8824 for your 1031 exchange. Think of it as a tax roadmap that keeps you on the IRS’s good side and your capital gains safe.

Dot every ‘i’ and cross every ‘t’ when reporting property swaps to avoid audits. Keep things tight, timely, and accurate—because no one likes tax trouble.

Work with an intermediary who guards your transaction like treasure; they’re key in making sure everything runs without a hitch while keeping those gains deferred.

Timing Constraints and Identification Rules

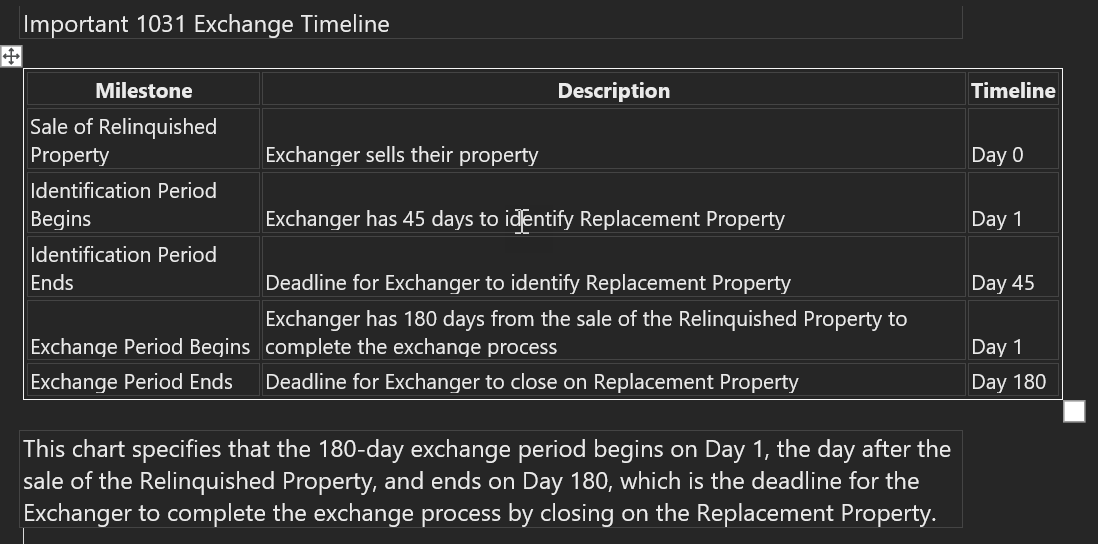

Tick tock, the clock doesn’t stop when you’re in a 1031 exchange. From the moment you wave goodbye to your old property, known as the relinquished property, you’ve got some serious deadlines to meet. Here’s where things get real; there are time limits for identifying replacement property that could make or break your tax-deferred dreams.

Understanding The Clockwork of Replacement Property Identification

The IRS isn’t kidding around with their timing requirements for completing a 1031 exchange. You have exactly 45 days from closing on your sold asset to declare potential new investments—your identification rules for replacement property come into play here. And trust me, this isn’t just an arbitrary number; it’s set in stone by our friends at Internal Revenue Code Section 1031.

This step is like speed dating with real estate—you’ve got a limited window to find “The One” (or ones) out of all eligible properties out there. So mark that calendar because if day 46 rolls around without any prospects in sight, well… let’s just say it won’t be pretty for your tax situation.

The Home Stretch: Wrapping Up Your Exchange

You made it past identifying what could be love at first sight with some hot properties—but hold up. There’s more track ahead before reaching that sweet finish line free of capital gains taxes. Reporting exchanges properly using Form 8824 isn’t optional; it’s essential. By doing so correctly within these windows ensures Uncle Sam gives his blessing rather than sending auditors knocking on your door.

A piece of advice? Don’t think twice about getting help from pros who eat IRS regulations for breakfast—they can guide you through every twist and turn until everything wraps up neatly within the grand finale deadline: Completing purchase no later than 180 days after saying adios to your original investment—or due date of income tax return including extensions whichever comes first.

Keep your eye on the clock in a 1031 exchange, because timing is everything. You’ve got just 45 days to pick new properties and up to 180 days to close the deal—or risk losing tax deferral perks.

Don’t mess around—miss these IRS deadlines and you could face some hefty taxes. Get expert help to navigate this high-stakes real estate race against time.

Case Studies Demonstrating Effective Use of Exchanges

Real estate investors often seek creative strategies to maximize their returns, and the Section 1031 exchange is a prime example of this ingenuity. Let’s explore some success stories where savvy players in the property game made moves that paid off big.

Revamping an Apartment Building Portfolio

A real-life scenario unfolded when an investor used a 1031 tax-deferred exchange to transition from managing high-maintenance single-family rentals to owning an apartment building with less overhead. By exchanging several properties for one larger asset, they consolidated efforts and reduced expenses, which ultimately boosted their net income significantly.

This strategic maneuver didn’t just cut down on management headaches; it also deferred capital gains taxes that would have chipped away at profits had they sold outright. The move was akin to trading up collectible cars without paying sales tax each swap—keeping more money revved up for future investments.

Navigating Timing Constraints Successfully

In another case study, strict adherence to identification rules played a crucial role in pulling off a seamless transaction within the tight timing requirements dictated by IRS guidelines. An investor identified potential replacement properties well before crossing the finish line on selling their relinquished property—a race against time where precision and speed were key.

Their ability to identify suitable like-kind exchanges early allowed them ample room to breathe through what could otherwise be a sprint fraught with stress if left too late. It proved yet again that understanding exchange rules, including those pesky deadlines, can make or break your experience with Section 1031 transactions.

Leveraging Improvement Construction Swaps for Growth

An inventive business owner turned their eye towards improvement construction swaps under Section 1031 exchanges as part of advanced strategies in real estate development—an ambitious but rewarding endeavor when executed correctly. They leveraged extra money into constructing improvements on replacement property owned by the exchange partner before finalizing possession—a slick way of adding value upfront while still under IRC protections from immediate taxation.

This bold play requires careful coordination between all parties involved but illustrates how thinking outside conventional parameters can unearth new avenues for wealth expansion via astute application of internal revenue code allowances—proving there’s always more than one way to build an empire.

Real estate moguls are using 1031 exchanges to turn single-family rentals into lucrative apartment buildings, dodge capital gains taxes, and beat IRS deadlines. They’re even building improvements pre-possession to supercharge growth.

Advanced Strategies Involving Section 1031 Exchanges

The savvy real estate investor knows that the 1031 exchange is a tool not just for deferring capital gains taxes, but also for strategic portfolio enhancement. Beyond the basics lies a realm of advanced strategies like reverse deferred exchanges, improvement construction swaps, and personal residence conversions.

Reverse Deferred Exchanges: Timing Your Trade Upside Down

In a classic 1031 scenario, you sell before you buy; but what if we flipped it? Enter reverse deferred exchanges. This approach lets you grab your ideal replacement property now without having to rush selling your relinquished one. But remember, the clock starts ticking as soon as you close on the new asset—45 days to identify which properties are waving goodbye and 180 days in total to seal those deals.

Making this strategy work requires finesse and an experienced intermediary who can navigate these choppy waters while keeping your transactions IRS-compliant—a move akin to swapping hats with Houdini.

Improvement Construction Swaps: Building Value Before You Buy

Dreaming of customizing a property before it’s even yours? With improvement construction swaps, dreams meet reality—you’re allowed to use exchange funds for renovations on your new investment as part of the swap itself. It’s all about enhancing value from day one.

But be warned. Every nail hammered or paint dabbed must be completed within that strict 180-day window post-closing—and every penny spent needs meticulous documentation when filing Form 8824. It’s playing Tetris with time and improvements where only precision secures success.

Personal Residence Conversions: A Home Run Play?

Last up is turning investments into homesteads—or vice versa—with personal residence conversions. Think about transforming rental properties into future retirement nests after fulfilling requisite holding periods or going full circle by converting homes back into rentals under section guidelines later down life’s road.

This chess-like maneuver demands understanding nuanced rules around primary residences versus rental holdings—but get it right and watch tax benefits cascade in ways that might make even Uncle Sam smile (or at least nod respectfully).

No doubt these moves aren’t for novices; they’re complex financial origami folding space-time-money continuums requiring expertise lest things crumple disastrously. So here’s my straight-up advice: partner up with pros who eat IRS code for breakfast—their know-how could mean more cash flow (and fewer headaches) for you.

Turn the 1031 exchange into your secret weapon by mastering advanced moves like reverse swaps, construction upgrades before purchase, and savvy home conversions. Just remember to team up with a pro who knows the IRS playbook inside out.

Additional Considerations Before Initiating an Exchange

Embarking on a 1031 exchange isn’t just about deferring capital gains taxes—it’s a strategic move that demands careful consideration of several factors. Real estate investors need to weigh market conditions, financial planning implications, and partnership issues before leaping into this tax-deferred transaction.

Market Conditions: The Right Time for the Right Move

The real estate market ebbs and flows with economic trends, making timing critical in your decision-making process. A property might look like gold today but could be less attractive if market dynamics shift tomorrow. You’ve got to have your finger on the pulse of both local and broader markets because they can significantly impact the value of properties you’re considering for your exchange.

Analyzing past trends helps too; it lets you predict which way the wind is blowing so you can sail smoothly through your investment journey without hitting rough seas.

Financial Planning Implications: Long-Term Gains over Short-Term Wins

Your focus should not solely be on immediate tax savings when pondering a Section 1031 swap. Think bigger picture—your entire financial landscape needs scrutiny here. It’s vital to ensure that any replacement property aligns with long-term investment goals while still catering to current fiscal realities.

Dig deep into how swapping assets affects everything from liquidity to retirement plans because these exchanges are more than just quick fixes—they’re part of building wealth over time.

Partnership Issues: All for One or One for All?

If you’re tangled up in business partnerships, things get trickier. Every partner must be singing from the same hymn sheet when it comes down to exchanging properties owned jointly—a unanimous chorus line saying ‘yes’ is essential.

Sometimes partners may want out altogether rather than reinvest their share—an option worth exploring since it influences everyone involved in ways only collaboration (or lack thereof) can unfold. Carnegie Wealth 1031, as experts deeply entrenched within this realm, underscore this unity as pivotal—because let’s face it; no one wants a discordant note ruining what could potentially be harmonious profits ahead.

Before jumping into a 1031 exchange, savvy investors should size up market conditions, assess how it fits with their financial goals, and get on the same page with partners.

A well-timed move considering market trends can turn good deals into great ones. Think beyond tax breaks—focus on how an exchange shapes your long-term wealth building.

In partnerships? Unity is key. All must agree to swap or explore options like cashing out for those who want to exit the investment.

Conclusion

By now, you know what is a 1031 exchange—a powerful tool in deferring capital gains, depreciation recapture and Net Investment Income taxes. Remember the essentials: like-kind properties and timing are crucial.

Navigate wisely; choose your intermediary with care. They’re key to this financial dance.

Report right; IRS Form 8824 awaits. Accuracy here keeps you clear of disputes.

Dive deep into the rules, seize those benefits—strategic swaps mean more growth for your portfolio.

Tread carefully considering market conditions and partnerships before leaping into exchanges.

This isn’t just a transaction; it’s an investment evolution. Armed with knowledge, make moves that matter—transforming taxes deferred into opportunities earned.